CIBIL Score Simulator – Knowing and Improving credit score is extremely important when it comes to applying for a credit card or loan.

The credit card company and bank check your credit score to approve your loan and credit card application. A low CIBIL score means rejection of a loan application.

There are multiple ways to check and improve your credit score. Even I have shared 7 ways to improve credit score in my previous post.

However, I feel that you need a tool that helps you to perform an impact analysis on your credit score for your financial actions.

For example, if you pay off your credit card bills or if you take a new loan what impact it will make on your credit score. Now, you can do behavior analysis and know credit score impact by using the CIBIL score simulator.

CIBIL score simulator is a wonderful tool. Let’s explore further and try to get answers – What is the CIBIL Score simulator? How to use CIBIL Simulator to do impact analysis.

Before knowing more about the CIBIL simulator let’s take a look at what is CIBIL score and What Information Credit Information Report contains.

What is CIBIL Score?

A CIBL Credit Score is a three-digit numeric number that is issued by the credit agency CIBIL to the individual.

A CIBL score shows a summary of your credit history. The value of your CIBIL credit score ranges between 300 -900. The credit score plays a crucial role in deciding your trustworthiness and capacity to repay the loan.

The report mentioning information about CIBIL credit score in detail is known as a Credit Information Report.

Your credit score should be higher to get approval for high-value credit.

Here is a quick summary of the credit score range, credit health, and risk level.

| Credit Score Range | Credit Health | Risk Level |

| 850 – 900 | Excellent | Very Low Risk |

| 750 – 850 | Good | Low Risk |

| 650 – 750 | Fair | Moderate Risk |

| 500 – 650 | Poor | High Risk |

| 300 – 500 | Bad | Very High Risk |

What information Credit Information Report Contains?

The credit information report (CIR) contains a record of all your credit transaction such as loan EMI, credit card payments & history.

The CIR report contains the following information.

- CIBIL score & credit summary

- Types of credits taken by you till date.

- Loan sanctioned amount by the bank and outstanding amount.

- Detail of loans where you stood as a guarantor.

- Your loan repayment history, delay, and default.

- Inquiries that were made for your CIR by various banks.

- Your employment detail and job profile.

What is CIBIL Score Simulator?

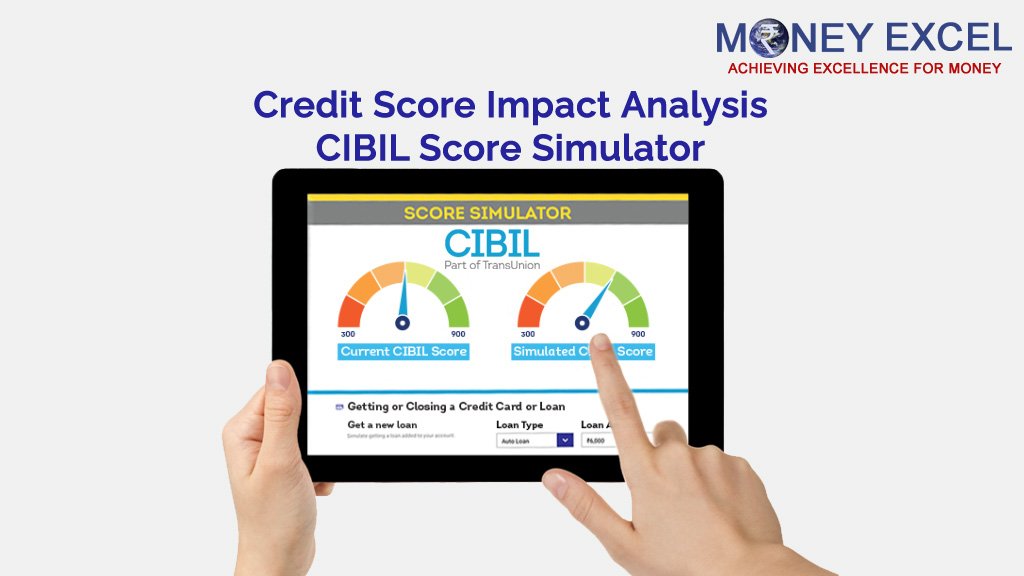

CIBIL Score Simulator is a facility that you can use to simulate different credit behaviors on your existing CIBIL report to generate a simulated CIBIL score.

It means you can simulate your credit behavior and exactly predict your credit score by using this tool.

Few examples where you can apply this tool to know the impact are –

- At the time of opting for a new loan or closing an existing loan.

- Paying outstanding credit card dues.

- At the time of opting for or applying for a new credit card.

- Opting for a credit card EMI facility.

- Credit card limit enhancement.

This means this tool is extremely important and helpful to understand how your credit behavior can affect your CIBIL score.

You can make informed financial decisions by using this tool.

You can even improve your credit score by using this tool.

How to use CIBIL Score Simulator for doing credit score impact analysis?

You require an active CIBIL member account (paid account) to access the CIBIL score simulator.

As a paid member, you will get a tab called “Score Simulator” in your CIBIL account.

Follow the step given below to perform a credit score impact analysis.

- Open the score simulator tool from your CIBIL profile.

- Select from the given credit behaviors (simulations).

- Enter the required additional information. E.g if you opt for a new credit card, you will be asked for a ‘Credit Limit’.

- After entering the required information, you will be able to see your credit score and simulated credit score side by side.

The subscription charges of CIBIL are Rs.550 for 1 month, Rs.800 for 6 months, and Rs.1200 for a year. Note – These charges are as of April 2022 and are subject to change anytime.

Benefits of using CIBIL Score Simulator

- Predicting credit score by simulating credit behaviors.

- CIBIL score impact analysis for credit behavior – Increase or decrease in credit score.

- You can improve your credit score by performing simulations and doing actual credit transactions.

- Helps you in making informed credit decisions to achieve your financial goals.

FAQ on CIBIL Score Simulator

Is it a Free tool?

Credit simulator by CIBIL is paid tool and available only to members who have taken a CIBIL subscription.

Does using a score simulator impact my credit score?

No, it is just a simulation tool to know the impact on the screen. The usage of this simulation tool does not change or impact your credit score.

Can I add a new simulation to this tool on my own?

No, as of now you need to use available simulations on this website. You cannot add any new simulation (Credit behaviors) on your own.

Over to You

I think it is a very good facility that helps in doing credit score impact analysis.

However, CIBIL should offer this facility at a lower cost or for free.

Have you used this facility? Do you think this facility is helpful?

Speak your mind and share with us at info@moneyexcel.com