Every Investment today comes with risk & return. The higher the risk, the higher the return that is a known fact. Asset class selection mainly depends upon individuals but given a chance, every individual will select low-risk and high-return investment right!

Many individuals today avoid stock market investment thinking that stock market investment is a risky affair. This is because the majority of them have experience in purchasing stock at overvalued/high prices so although it is blue-chip stock it may end up giving them low returns.

If we draw a risk and return diagram in two dimensional we have four types of stocks

(1) High Risk, High Return –Startup company with Strong business model

(2) Low Risk, Low Return – Several-year-old company giving low return

(3) Low Risk, High Return – Several-year-old company giving a good return

(4) High risk, Low Return – Startup company with weak business model

So, Million dollar question is how to select low-risk high-return stock in the equity market. Although it is a difficult question to answer we are here with a proven Capital Asset Pricing model that can help to select low-risk high-return investments.

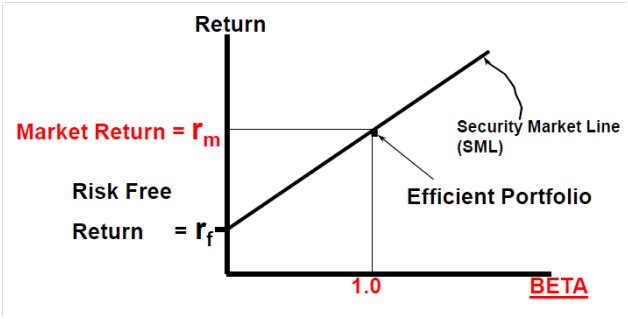

In the above diagram if we draw the parallel line, pointing it to the Y axis is known as a risk-free return. In the Indian context, risk-free return is said to be around 8% i.e risk-free return given by a bank on a deposit

The point of intersection in the Y axis is known as Market return and the X axis is known as Beta. Beta = 1 leads to an Efficient portfolio.

Beta measures volatility in a stock. It is the measure of systematic risk or more specifically, market risk of a stock investment.

Stocks that have a beta greater than 1 have greater price volatility than the overall market and are more risky.

Stocks with a beta of 1 fluctuate in price at the same rate as the market.

Stocks with a beta of less than 1 have less price volatility than the market and are less risky.

The higher the beta higher the risk you carry. There is no need to calculate betas of stocks (which would be a tedious process). Both Sensex and Nifty stocks’ beta values can be gathered from respective websites:

Please note these beta values are computed using trailing twelve months’ data.

This model is popularly known as the Capital Asset pricing model. (CAPM) The CAPM says that the expected return of a security or a portfolio equals the rate on a risk-free security plus a risk premium. If this expected return does not meet or beat the required return, then the investment should not be undertaken.

CAPM describes the relationship between risk and expected return and that is used in the pricing of risky securities.

![]()

R = Expected return on a company stock

B = Beta of the stock

rf = Risk-free return

rm= return on the efficient market portfolio

We can compute the expected return of a stock in this CAPM example: risk-free return is 8%, the beta (risk measure) of the stock is 2 and the expected market return over the period is 10%, the stock is expected to return 12% (8%+2(10%-8%)).

Beta is just one measure to identify low-risk high return stock, while selecting stock one should carefully consider company fundamentals, core business, and past return that will give you a much better picture of the potential long-term risk.