Best Mutual Funds Child Education – We always dream to give the best education to our child but do we really think about the growing cost of child education? We want a child to become doctor, engineer or businessmen but do we really plan for it? As per me saving for child education is the most important goal for parents. Other goals like buying a car or buying a home can be compromised, but we should not compromise our child education.

As you know that the cost of Education in India is growing like anything. To meet expenses of higher education, you need to arrange more funds either from your own pocket or you need to borrow the money. The only way to finance your child education in the future is sound financial planning and investment strategy.

Mutual Fund is one of the best and preferred investment option for child education. By investing in mutual funds, you can help your child to achieve his or her future dreams. In this post, I will share Best Mutual Funds for Child Education in 2021. Before disclosing best mutual funds for child education let’s try to estimate – How much money will be required for Child Education in Future?

Also Read – How to Find Best Child Education Investment Plan

Estimating Cost of Child Education in the Future

The cost of education in India is rising at an unprecedented rate. The reason for this is very simple.

A lack of policy by the government to regulate private school and colleges. Moreover, the shortage of physical infrastructure and a highly qualified teacher is another problem. A teacher to student ratio is very high and teachers are not well trained. In most of the school and colleges, teachers do not teach in their regular classes and create a situation where students are required to opt for tuition. All these things ultimately cause an increase in education cost in India.

As per rough estimates, the cost of education is increasing by 10% on annual basis. On conservative estimate engineering course that costs 6 Lakh at present will likely to cost 15 Lakh after 10 years. Similarly, an MBA course costing 10 Lakh will cost 25 Lakh after 10 years.

Data shows that fees of premier institute IIT for engineering have increased by five times in the last 10 years. IIT (B.Tech) fee was 2.28 Lakh in 2008 and now it is 10 Lakh. Similarly, fees of IIM for PGP course has nearly doubled. A fee of PGP course in IIM Ahmedabad was 11.5 Lakh in 2008 and today it is costing 19.5 Lakh.

Forget premium institute like IIM and IIT, an average fee of Engineering course is roughly Rs 6 Lakh today, five years down the line it would be close to double meaning Rs 12 Lakh. In 10 years’ time, it’s likely to cost around Rs 20 Lakh.

The growing cost of education has no dead end. The options left with you succumb to the situation by taking education loan or plan for child education.

A mutual fund is one of the best investment options in India for child education planning. Here is a list of Best Mutual Funds for Child Education in India.

Also Read – Cost of Child Education – Planning & Calculator

Best Mutual Funds for Child Education in 2021

Shortlisting method for Mutual Funds –

- Type of Funds -The first factor for the shortlisting is a type of fund like large cap, small cap, mid cap, and balance etc. I have tried to shortlist fund in all categories.

- Fund performance – The second factor used for shortlisting of a fund is the fund performance. I have selected the best performing fund 5-10 years’ time frame.

- Benchmark – I have taken into consideration the performance of the fund against a benchmark index.

- Fund Rating – Another factor of shortlisting is fund rating. Higher the fund rating better is fund. I have considered a rating given by Value Research. The fund rating above 3 stars is considered.

Some of the funds might be a repetition of earlier recommendations. My recommendations are divided into three parts long term, medium term, and short term.

Long Term – Child Age 0-5 Years

Suppose you are planning for child education for the newborn baby or for child up to age 5 years. Your child will enter the graduation phase at the age of 18 years. This means you have a couple of years in hand. To be precise you have 13-18 years’ time frame. You should plan to invest in large cap, mid cap and small cap funds that offer the highest growth potential.

First step is to estimate child education cost in the future. You can take reference from the above section. Once you arrived at the required corpus second step is to calculate monthly investment amount required.

Case – 1

- Age of Child – 0 Year

- Corpus Required – 20 Lakh after 18 Years

- Expected rate of return by Mutual Funds – 15%

SIP Amount required in the above case would be Rs.2100.

Case – 2

- Age of Child – 5 Year

- Corpus Required – 20 Lakh after 13 Years

- Expected rate of return by Mutual Funds – 15%

SIP Amount required in the above case would be Rs.4600.

Here are few recommended Mutual Funds for long term investment. These mutual funds are mix of large cap, mid cap and hybrid.

Note – Above mutual funds returns detail is as on Feb,2019.

Medium Term – Child Age 6 -10 Years

Suppose you are planning for child education for the child in the age group of 6-10 Years. This means you have 8-12 years’ time frame. You should plan to invest in large cap, multi cap and Hybrid funds.

You need to follow a similar method given in the section above to arrive at corpus figure. The only change here would be age of the child and required time frame for investment.

Case – 1

- Age of Child – 6 Year

- Corpus Required – 20 Lakh after 12 Years

- Expected rate of return by Mutual Funds – 15%

SIP Amount required in the above case would be Rs.5500.

Case – 2

- Age of Child – 10 Year

- Corpus Required – 20 Lakh after 8 Years

- Expected rate of return by Mutual Funds – 15%

SIP Amount required in the above case would be Rs 11500.

Here are few recommended Mutual Funds for medium term investment. These mutual funds are mix of large cap, multi cap and hybrid.

Note – Above mutual funds returns detail is as on Feb,2019.

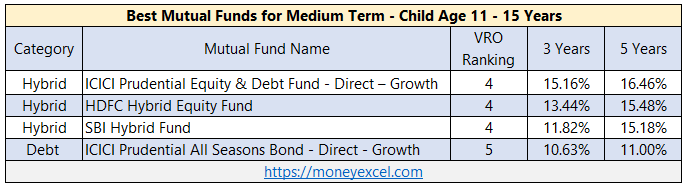

Short Term – Child Age 11-15 Years

Suppose you are planning for child education for the child in the age group of 11-15 Years. This means you have 3-7 years’ time frame. As this time frame is very low it is advisable to invest in mix of debt fund and hybrid funds.

Here are few Best Mutual Funds for short term investment. These mutual funds are mix of debt fund and hybrid funds.

Note – Above mutual funds returns detail is as on Feb,2019.

Food for Thought

A purpose of this article is not to increase your worry about the cost of child education but make yourself aware of the situation so that appropriate step can be taken.

Do share your experience and views about the cost of education by adding comments.