A credit score is a crucial thing for getting a loan. You might have seen that it is very easy for few people to get loans, while other struggles a lot to get a loan. The main reason behind quick and easy loan approval is creditworthiness. A creditworthiness is determined by a credit score. It denotes whether you are a safe borrower or a risky borrower. If your credit score is good you are a safe borrower and if your credit score is bad you become a risky borrower. A good and bad credit score is determined by various factors like loan repayment history, no payment delay etc.

Why Credit Score?

Earlier, when the number of individual borrowers was small, each bank or lender used to do its own due diligence for determining credit ratings. However, at a later stage due to the increase in numbers of borrowers CIBIL organization was institutionalized. CIBIL stands for Credit Information Bureau Limited. It maintains credit information records of every individual. Based on the credit rating CIBIL assigns a credit score to the individuals. A credit score is a three-digit number between 300 and 900. Higher the credit score better is your creditworthiness. Bank and NBFC will be comfortable in offering you a high-value loan and credit card if your credit score is good.

Here is a quick summary of credit score range, credit health, and risk level.

| Credit Score Range | Credit Health | Risk Level |

| 850 – 900 | Excellent | Very Low Risk |

| 750 – 850 | Good | Low Risk |

| 650 – 750 | Fair | Moderate Risk |

| 500 – 650 | Poor | High Risk |

| 300 – 500 | Bad | Very High Risk |

By now, you must have got a fair idea about the importance of a good credit score. Now, let’s look at benefits of good CIBIL credit score.

Also Read – Free CIBIL Credit Score on WhatsApp

Benefits of Good Credit Score

- Fast Loan Approval and processing – Your loan approval and processing will be faster if your credit score is good.

- Instant Credit Card Approval with higher limit – Your credit card approval will be instant and faster. You will get a higher credit limit in credit cards.

- Higher loan amount – Your chance of getting approval for higher loan amount will be higher.

- Low-interest rates – Bank and NBFC may offer low-interest rates if your credit score is good.

- Higher Repayment Tenure – You may be offered higher repayment tenure by banks or credit card companies.

Looking at benefits give above you must be excited to know and improve or boost credit score.

Well, now you can get a free copy of a credit report every year. A credit report contains your credit score.

Also Read – How to get Free CIBIL Credit Score Report?

If your credit score is good you 750 or above, you need not to do anything. But, if your credit score is below 650 you should follow the steps given below to improve and boost credit score.

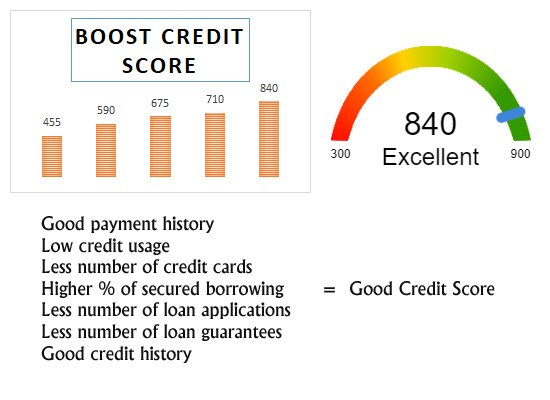

7 Ways to Improve and Boost Credit Score

No late payment or defaults

The first thing you need to do is maintain a habit of paying on time. No one likes late payment of defaults. Make sure you pay all your credit card dues and loan EMI on time. This is sure-shot ways to improve and boost your credit score. If you are bad and remembering dates of making payments you should setup auto debit facility in credit card and EMI.

Don’t consume entire credit limit

The second sure-shot way to boost your credit score is following a rule of not consuming entire credit limit. Higher outstanding balance impact your credit score negatively. Keep utilization of your credit card limit under control. I recommend only consuming 1/3rd of maximum credit limit.

Keep only few credit card and loans

You should reduce number of loans and credit cards. You can cancel all your unused credit cards and keep one or two. If possible reduce number of loans by making repayment. It will surely help you to improve your credit score.

Mix of Borrowings

Having a combination of secured and unsecured loans helps you to build and maintain a good credit score. It also influences your ability to borrow. It is recommended to reduce you unsecured loan and credit card outstanding.

Stop loan and credit card inquiries

You should not send too many inquiries about loans or credit cards to lenders. Sending too many inquiries indicates that you have financial problems and you are looking for borrowings. This will reduce your credit score.

Don’t become a guarantor for others

Don’t become a guarantor for others. When you become a guarantor for other loans you are liable to pay dues in case borrower fail to pay dues. It is the biggest risk on creditworthiness. You should avoid becoming a guarantor for others to boost credit score.

Maintain Good Credit History

Last way to boost your credit score is to maintain good credit history. If you maintain good record of repayment your credit score will improve.

Conclusion –

Hope you are now clear about how to Boost Credit Score? If you wish to add any important points about improving credit score feel free to share the same in the comment section.