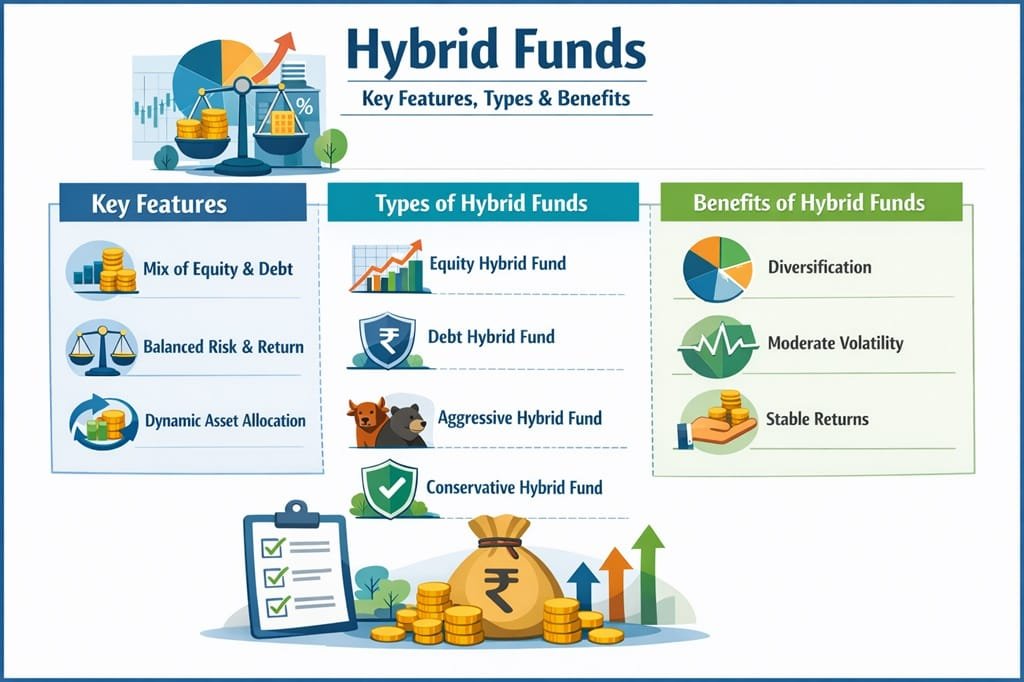

Hybrid Funds means funds made by combining two or different category of assets equity and debt. As hybrid fund invest in two asset categories investor can avail the benefit of both. The Hybrid Fund offers maximum diversification and moderate returns. A hybrid fund is a combo of equity and debt. There are various types of hybrid funds available to Indian stock market investors. The decision of investing in hybrid mutual funds depends upon investors risk profile and investment objective. Prior to recategorization Hybrid fund was known as a balanced fund.

Picture this: You’re at a buffet, and instead of loading up on just spicy curries or bland salads, you mix ’em up for the perfect meal. That’s hybrid funds in a nutshell! These mutual funds invest in a combo of asset classes, mainly stocks (equities) for that growth kick and bonds (debts) for stability. Sometimes, they even toss in a bit of gold or real estate to spice things up. In India, the Securities and Exchange Board of India (SEBI) keeps a close eye on them, ensuring they’re categorized properly so investors know what they’re getting into.

Why bother with hybrid funds? Well, life’s unpredictable, right? The stock market can swing like a pendulum, and pure debt funds might not keep up with inflation. Hybrid funds aim to smooth out those bumps, offering a middle ground. They’re managed by pros who tweak the mix based on market vibes, saving you the headache of doing it yourself. And get this – they’re accessible to everyone, from fresh-out-of-college millennials to retirees eyeing steady income. No wonder they’ve become a staple in many Indian households’ investment plans!

How Do Hybrid Funds Work Behind the Scenes?

Ever wondered what happens after you invest? The fund pools money from thousands like you, then allocates it per the scheme’s mandate. For instance, an aggressive hybrid fund might park 70% in blue-chip stocks from NSE giants like Reliance or HDFC, and the rest in government bonds or corporate debts. Fund managers use tools like fundamental analysis and economic indicators to decide – it’s like having a financial wizard on your team. And with SIPs (Systematic Investment Plans), you can drip-feed investments, averaging out costs over time. Simple, effective, and oh-so-convenient!

Types of Hybrid Funds

Hybrid funds aren’t one-size-fits-all; they’ve got varieties to match your risk appetite. Think of them as different ice cream scoops – some bold, some mild. Here’s a rundown:

Aggressive Hybrid Funds

These are for the thrill-seekers! With 65-80% in equities and the rest in debt, they chase higher returns but with a cushion. Ideal if you’re young and can handle market dips. In India, funds like HDFC Hybrid Equity Fund have delivered solid gains over the years. Pros? Potential for double-digit returns. Cons? Volatility can keep you up at night.

Balanced Hybrid Funds

The middle child – balanced and reliable. They keep equity at 40-60%, blending growth with stability. Great for moderate risk-takers, like working parents saving for kids’ education. SEBI mandates no arbitrage here, keeping it straightforward.

Conservative Hybrid Funds

Playing it safe? These allocate just 10-25% to equities, focusing on debt for steady income. Perfect for retirees or those nearing big life goals. They offer regular dividends, acting like a pension supplement. But returns? More modest, around 7-9% annually.

Dynamic Asset Allocation Funds

These chameleons adjust automatically! Fund managers flip between equity and debt based on market valuations – high P/E ratios? Shift to debt. Low? Go equity-heavy. It’s hands-off for you, but requires trusting the manager’s gut.

Multi-Asset Allocation Funds

Why stop at two? These invest in at least three assets – stocks, bonds, gold, maybe commodities. In volatile India, they shine by hedging against inflation or rupee dips. A bit more complex, but diversification on steroids!

Equity Savings Funds

Sneaky smart – they use equity, debt, and arbitrage (buying low, selling high in derivatives) to minimize taxes and risks. Often treated as equity for tax purposes, they’re a tax-efficient hybrid option.

Arbitrage Funds

Though sometimes lumped in, these focus on price differences between cash and futures markets. Low risk, but returns hover around fixed deposit levels. Good for parking short-term cash.

Each type suits different life stages – aggressive for the young guns, conservative for the wise owls. Mixing types in your portfolio? Even better!

Who should Invest in Hybrid Funds?

Hybrid funds are comparatively safer bets than pure equity funds. These funds provide higher return compared to debt fund. This fund is suggested for conservative investors with moderate risk appetite looking for income generation or capital appreciation. The equity component of fund offers the probability of higher return, at the same time, the debt component offers a cushion against market conditions.

As there are multiple types of hybrid funds available in the market, as an investor you must be careful in the selection of the right hybrid fund. If you are a conservative investor go for conservative hybrid funds or Arbitrage fund. If your risk-taking capacity is higher you can go for aggressive hybrid funds.

Points to consider while investing in Hybrid Funds

One should consider following points while investing in Hybrid Funds.

Risk – A Hybrid fund is not completely risk-free. It is less risky compared to equity fund as debt component is involved.

Return – Hybrid funds do not offer guaranteed returns. The returns entirely depend on market condition and performance of underlying assets.

Expense Ratio – Expense ratio is one of the important factors while making a decision of buying a mutual fund. You should select a fund with a lower expense ratio.

Investment Horizon – A Hybrid fund is ideal for medium-term investment horizon. The recommended investment horizon for a hybrid fund is 5 years.

Tax on Gain – Long-term capital gain tax and short-term capital gain tax both are applicable to mutual funds.

FAQs

What makes hybrid funds different from equity or debt funds?

Hybrid funds blend both, offering balance, while pure equity chases growth and debt focuses on safety.

Are hybrid funds suitable for beginners?

Absolutely! Their diversification makes them less intimidating than stocks alone.

How are hybrid funds taxed in India?

Equity-oriented ones (65%+ stocks) get LTCG tax at 10% over ₹1 lakh. Debt-heavy follow debt fund rules.

Can I withdraw from hybrid funds anytime?

Yes, but check exit loads – usually 1% if redeemed within a year.

What’s the minimum investment for hybrid funds?

Often ₹5,000 for lump sum, ₹500 for SIPs – super accessible!

Do hybrid funds guarantee returns?

Nope, markets fluctuate, but their mix aims for steadier performance.

Wrapping it up, hybrid funds in India are like that reliable friend who keeps you grounded yet pushes you forward. With their key features like diversification and flexibility, various types to suit every taste, and benefits ranging from tax perks to balanced returns, they’re a no-brainer for smart investing. Whether you’re dodging market volatility or building a nest egg, incorporating hybrid funds can supercharge your portfolio. So, why wait? Chat with an advisor, pick a fund, and start your journey today. After all, in the wild ride of Indian markets, a hybrid approach might just be the ticket to financial peace.