Direct Mutual Funds, as the name suggests, are for direct investor where no intermediary or distributor is involved in making an investment. It makes sense to Direct mutual fund as it provides multiple benefits like low expense ratio, better returns over long-term and elimination of commission.

The elimination of commission and lower expense ratio seems to be minimum at first instance, but over the long run, it will make a lot of difference in returns generated by the mutual fund.

To know more about a difference in return between a regular mutual fund and direct mutual fund, do read – Why Direct Plans are cheaper?

Investors who have realized the potential of a direct plan may have already shifted to them. The Investors who are unaware of benefits of the direct mutual fund might not have moved to direct plan. Even exit load and lock-in period might be a concern to many investors.

Also Read – Direct Mutual Funds Platforms for online Investment in India

If you are convinced that direct mutual fund is a better choice compared to regular mutual fund and planning to switch to direct mutual funds this post is for you. In this post, I will share information about switching from Regular Mutual Fund to Direct Mutual Fund – Online and Offline method.

However, before making a switch from the regular fund to direct fund you need to consider various important factors affecting this switch.

Why Switch to a Direct Mutual Fund?

Before we jump into the how-to, let’s talk about the why. Regular mutual funds are managed by intermediaries or distributors who charge a commission for their services. While this might seem like a small cost, over time, these charges can eat into your returns. Enter direct mutual funds. They cut out the middleman, which means lower expense ratios and better returns for you. Plus, you’re in the driver’s seat, calling the shots and keeping more of your hard-earned money.

The Basics: Regular vs. Direct Mutual Funds

Regular Mutual Funds

These come with a distributor’s commission embedded in the expense ratio. You’re essentially paying for advice, convenience, and the services of a middleman.

Direct Mutual Funds

These skip the commission, offering a lower expense ratio and potentially higher returns. They’re ideal for seasoned investors or anyone willing to learn the ropes.

Important factors to consider before switching from Regular Mutual Fund to Direct Mutual Fund –

Elimination of Distributor Services

The step of switching from the regular fund to direct fund means an indirect elimination of distributor services. The distributors provide you a consolidated direct platform for an online transaction where you can buy and sell mutual funds. They also remove the need for paperwork. They charge fees for this. If you are moving to direct plan means you will not use services of distributor anymore. So, you have to be ready for handling more paperwork and working with multiple platforms.

Exit Load

Second important factor for consideration while switching from regular plan to direct plan is exit loan. Exit load is applicable on redemption of the units which are held less than one year. So, you have to bear applicable exit load on a mutual fund. If you have invested via SIP route, the exit load is calculated from the date of each installment.

Once you switch to direct plan new tenure will begin so exit load period will be calculated from the date of switching. If your financial goals are due to mature in short term you should avoid this switch.

Recommended – 3 Ways to Invest in Direct Mutual Funds Plans

Lock-in period

If you have invested in ELSS, it comes with lock-in period means you cannot switch from these type of fund till lock-in period is over. The lock-in period in ELSS case is 3 years.

LTCG

You also need to consider LTCG (Long-term capital gain) tax applicable on the mutual fund. You must be aware that as per new rule LTCG @10% is applicable to capital gain above 1 Lakh. This rule is applicable from FY 2018-19 onwards.

This means if your capital gain is exceeding 1 lakh, you need to start withdrawal in a manner that you will not lose money. Remember for switching also LTCG is applicable.

Stock Broker

If you have invested via a stockbroker, your stock broker should support direct plans. Please note that switching of a fund from a regular fund to direct plan will not be possible if your stockbroker is not supporting direct plan option. In that case, the only option left with you is redeeming mutual fund and investing it again in direct plans.

I hope you are clear about switching of funds. If you need any help you can consult fee-only financial planners. Now, let’s take a look at How to switch from Regular Mutual Fund to Direct Mutual Fund?

How to switch from Regular Mutual Fund to Direct Mutual Fund?

Offline Method

The offline method of switching fund is given below. This method is applicable for all funds.

- Visit the office of fund house or respective Mutual Fund distributor. You can get information about registered mutual fund distributor from AMFI website.

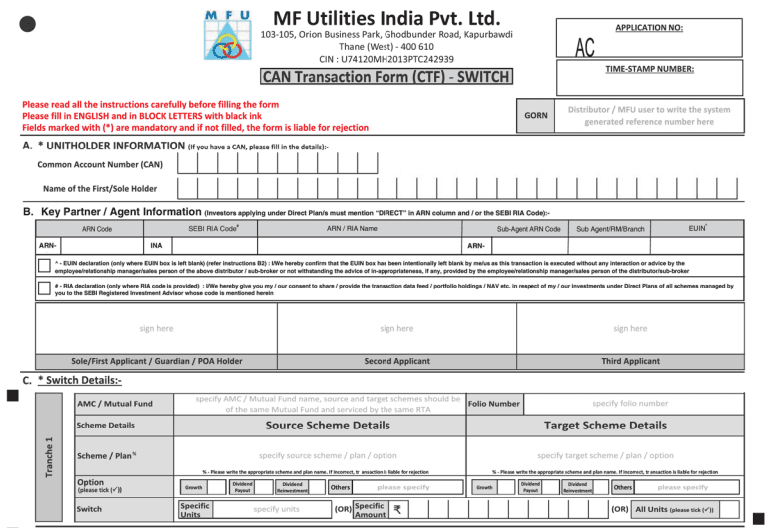

- Ask for the Common Transaction Form for Switching Mutual Fund. If you have CAN at MFU you can also use the form available at MFU website. Fill up the form with required details along with source scheme and target scheme details. A sample form screenshot is given below. You can also use fillable form.

- Make sure all details are correct, especially source scheme, target scheme, amount and number of units to be switched. After verification sign it on the form and submit it to respective center.

- Collect the acknowledgment receipt as a proof of submission.

- Once transaction takes place you will get email and SMS intimation on register email ID/Mobile number.

Also Read – How to invest in Direct Mutual Funds Plans?

Online Method

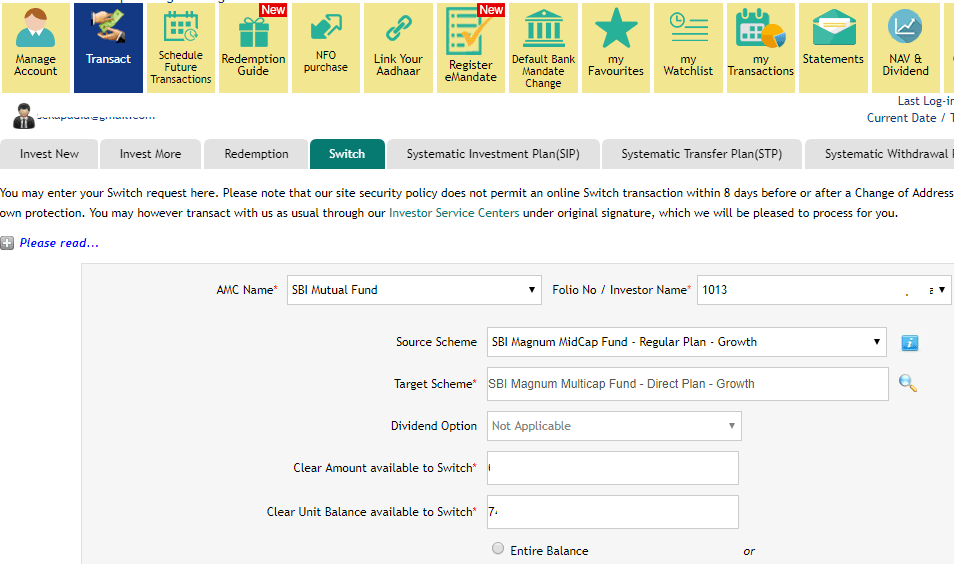

The second method of switching fund is an online method. This method varies from fund house to fund house. I have used online method of switching fund via myCAMS which is described below.

- Visit myCAMS site and log in using your username and password.

- From Top navigation, click on Transact icon.

- You will be redirected to the page where it will show various options such as Invest more, Redemption, Switch, Systematic Investment Plan, Systematic Transfer Plan etc.

- Click on Switch, you will be prompted to select AMC Name. Drop down menu only displays a list of AMC where you are holding mutual funds.

- Select AMC and Folio Number. You will be asked to provide Source Scheme and Target Scheme. You have the option to switch entire balance or number of units.

- Accept terms and condition and press on switch button to initiate switching. You can also schedule this transaction at later date.

- On submission, you will get a confirmation page. The certain portals may ask transaction PIN or ask to re-enter your password for verification.

- Once the process is completed you will receive intimation on your registered email id and mobile via SMS.

Step-by-Step Guide to Switching

Switching isn’t as complicated as it sounds. Here’s a step-by-step guide to help you transition smoothly –

1. Evaluate Your Current Investments

First things first: take stock of your current mutual fund portfolio. Look at your funds’ performance, expense ratios, and exit load. Why? Because some funds may charge an exit load (a small penalty) if you redeem units within a specific period. Also, selling your funds may trigger capital gains tax. Both factors can affect the overall profitability of your switch.

2. Understand the Tax Implications

Switching from a regular to a direct plan is treated as redemption and re-investment for tax purposes. This means:

- Equity Funds: Gains are taxed at 15% (short-term) or 10% (long-term if gains exceed ₹1 lakh).

- Debt Funds: Short-term gains are taxed as per your income slab, while long-term gains attract a 20% tax with indexation benefits.

Crunch the numbers before making a move. Sometimes, the tax burden can outweigh the benefits of switching.

3. Choose Your Platform

You can switch directly through the Asset Management Company (AMC) website, a robo-advisory platform, or even apps like Groww, Zerodha, or Paytm Money. Each platform has its pros and cons, so pick one that aligns with your comfort level and ease of use.

4. Initiate Redemption in Regular Plan

To switch, you’ll first need to redeem your units in the regular plan. This is straightforward:

- Log in to your mutual fund platform or AMC website.

- Select the regular mutual fund you wish to switch from.

- Click “Redeem.”

- Specify the number of units or amount you want to redeem.

5. Reinvest in the Direct Plan

Once your funds are redeemed (usually takes 1-3 business days), reinvest the amount in the direct plan of the same mutual fund. Here’s how:

- Go to the AMC’s website or your chosen platform.

- Search for the direct plan of your desired mutual fund.

- Select “Invest” and input the redemption amount.

- Complete the transaction.

6. Track and Review

Switching is just the beginning. Keep an eye on your investments’ performance, expense ratios, and overall portfolio health. Direct plans require a hands-on approach, so stay vigilant.

Pro Tips for a Hassle-Free Transition

Stagger Your Switch – Instead of switching all your funds at once, consider staggering the process over a few months to minimize tax impact.

- Focus on Long-Term Benefits – Don’t get bogged down by short-term tax liabilities or exit loads. Think of the long-term cost savings.

DIY Research – Educate yourself about market trends, fund performance, and portfolio allocation to make informed decisions.

Common Mistakes to Avoid

- Ignoring Tax and Exit Loads: A hasty switch can lead to unnecessary costs. Always evaluate the financial implications.

- Overlooking Fund Performance: Don’t assume direct plans automatically outperform. Always review a fund’s historical performance.

- Not Staying Updated: Direct mutual funds require active management. Keep yourself updated with market changes and fund updates.

Switching from a regular mutual fund to a direct mutual fund can be a game-changer for your investment strategy. It’s all about cutting costs, maximizing returns, and taking control of your financial future. Sure, it’s a bit more work, but isn’t your hard-earned money worth it? Armed with the right knowledge and tools, you can make the transition seamless and rewarding.