You must be aware that it is mandatory to produce a Premium Paid Certificate for insurance policies to avail of Income tax exemption benefits under section 80 C. A Premium Paid Certificate is a document issued by an insurer against payment of the premium amount. This document is generally required for the policies premium paid via ECS and NACH mode. For all other modes of payment, you get a premium receipt which will act as proof of income tax benefit.

If you have purchased LIC policy, and looking for the premium paid certificate you have three options. You can either contact your LIC agent, you can approach your branch office or you can download the LIC Premium Paid Certificate Online. Out of these first two options are time-consuming and cumbersome. Downloading the LIC Premium Paid Certificate Online is a smart way will save a lot of time.

Why Do You Need the LIC Premium Paid Certificate?

Before we jump into the how-to, let’s talk about the why. The LIC premium paid certificate is your golden ticket to tax savings. Here’s why it’s crucial –

- Income Tax Deduction: The premiums you pay for life insurance policies are eligible for a deduction of up to ₹1.5 lakh under Section 80C. This means less taxable income and more money in your pocket.

- Proof of Payment: It’s an official document that confirms your premium payments. If you’re ever questioned by the Income Tax Department, this certificate has your back.

- Ease of Filing: Having all your documents in one place makes filing your income tax returns (ITR) a breeze. The LIC premium paid certificate is a vital piece of the puzzle.

Life Insurance Corporation of India (LIC) has launched a new facility for downloading LIC Premium Paid Certificates online via the e-service portal.

Also Read – My LIC & LIC Customer New Andriod App by LIC

Download LIC Premium Paid Certificate Online For Income Tax

Follow the steps given below to download LIC Premium Paid Certificate Online.

1. Register Online for LIC e-Services

The first step is to register online at the LIC e-Services Portal. A facility of LIC e-Services is extended to a customer, branch manager, & agent. If you are already registered with e-Services use your User ID and Password for login. On the other hand, if you are a new user you have to sign up for using this facility. You need to provide the policy number, premium amount, mobile number, email, and Aadhaar details for registration.

2. Login to e-Service Portal

The second step is to log in to LIC’s e-Service portal using your USER ID, Password, and Birth date.

3. Go to the Basic Services

The next step is to click on the Basic Services option under My App. The basic service option allows you to access your premium calendar, policy schedule, claim status, and policy premium paid statements. Once you click on the Basic Service option you will be taken to the “Proceed” button. Press it to proceed further.

Also Read – Loan against LIC Policy – Online Facility

4. Go to Policy Premium Paid Statement

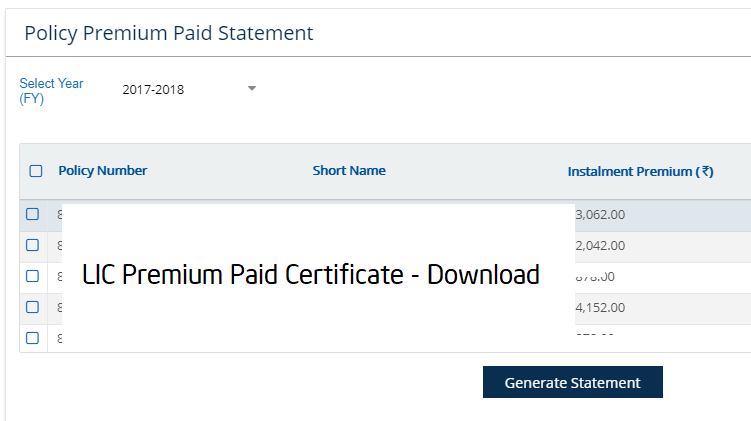

Go to Policy Premium Paid Statement from the left side navigation menu as shown in the image below. You will be taken to another page where you need to select Financial Year. Once you select the financial year system will display a list of policies along with installment premium details.

5. Select Policy for Premium Paid Statement

You need to select a policy for which a certificate is required. In case you are looking for a single consolidated statement, select all policies.

6. Generate a premium paid certificate

Click on the “Generate Statement” button given below the list and you will be able to download the Premium Paid Statement in a PDF format.

Make sure that your pop-up blocker is turned off else you will not able to download/see the statement.

The statement contains information about all selected policies including premium mode, amount, received date, collecting, and servicing branch. If you find any mismatch in the statement you have to contact LIC local branch.

Submit the LIC Premium Paid Certificate to your employer and claim income tax exemption under section 80C.

Alternative Method: Download Through the LIC Mobile App

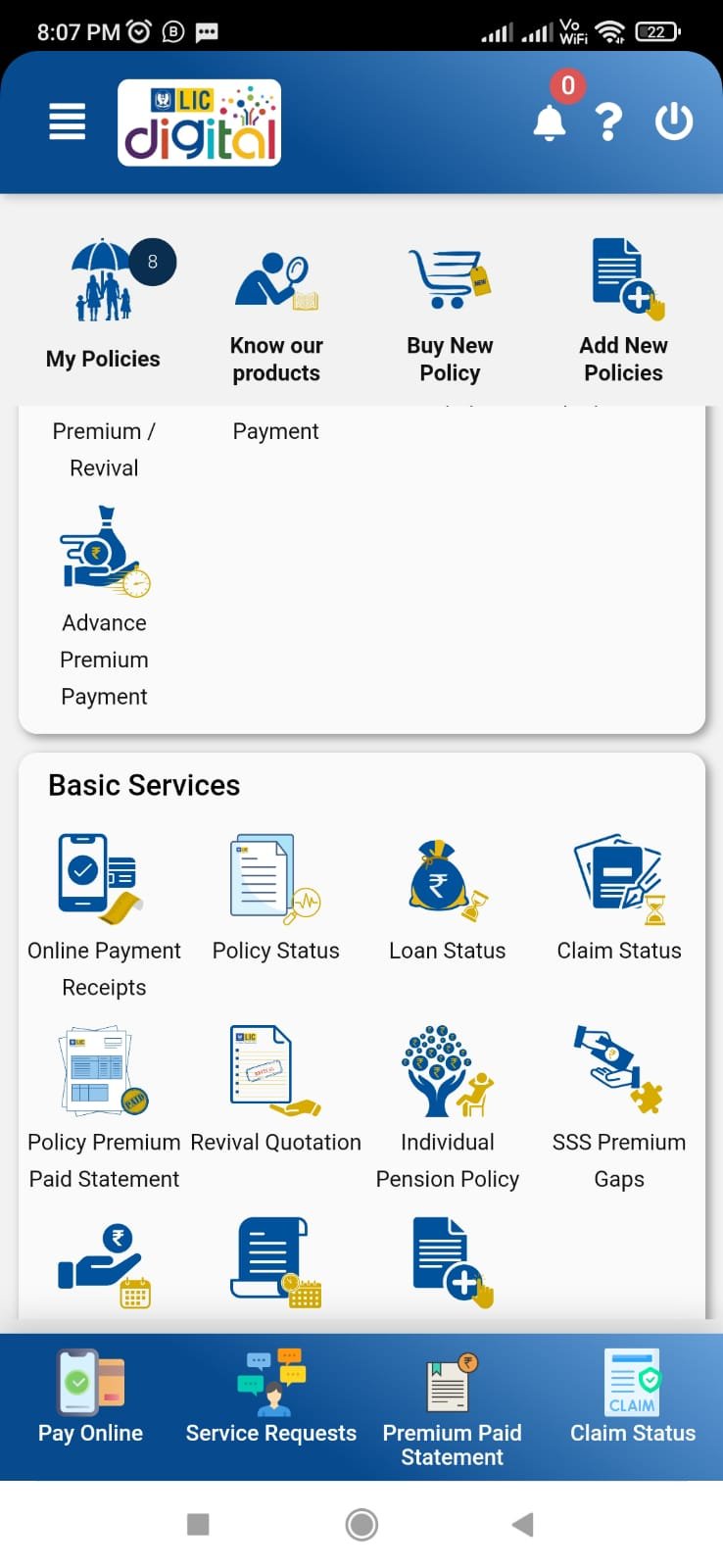

For those who prefer managing everything on their smartphones, LIC’s official app, “LIC Digital,” has got you covered. Here’s how to do it:

- Download the App – Get the app from Google Play Store or Apple App Store.

- Login/Register – Use your credentials to log in. New user? Register first. If you are already registered, you can login via Username & Password or by entering mobile number and birthdate.

- Navigate to Premium Statements – Now visit Basic services section. In this section, you can find “Online Payment Receipts”. Click on that.

- Download – Now select Financial Year. Select your policy and click on the download button. Alternatively, you can select all and Download Policy Premium Receipt.

- Premium Paid Statement – If you want to download entire statement. Click on Premium Paid Statement and follow on screen instruction to Generate Statement.

Tips to Keep in Mind

- Ensure Correct Details: Double-check the policy details you enter. Any mismatch might delay the process.

- Secure Your Login: Use a strong password for your LIC account and avoid sharing it with anyone.

- Save Multiple Copies: Once downloaded, save the certificate in multiple places—your laptop, a USB drive, or even cloud storage. Better safe than sorry!

- Keep It Handy: When filing your ITR, have this document ready to avoid last-minute scrambling.

FAQs

1. Can I get the premium paid certificate offline?

Absolutely! Visit your nearest LIC branch, and they’ll provide the certificate. However, the online method is much faster and hassle-free.

2. What if I forget my LIC portal password?

Don’t panic! Click on the “Forgot Password” option on the login page. You’ll receive a reset link on your registered email or phone.

3. Is the LIC premium paid certificate valid for all policies?

Yes, it’s valid for all LIC policies where premiums are eligible for tax deductions.

4. Can I download certificates for past years?

Yes, LIC’s portal usually allows you to access premium paid statements for multiple years. Select the relevant financial year when downloading.

5. Is there any fee for downloading the certificate?

Nope, downloading the LIC premium paid certificate is completely free of charge!

Final Words

Downloading your LIC premium paid certificate online is a game-changer. It’s quick, easy, and incredibly convenient—no more branch visits or paperwork hassles. Plus, it ensures you’re always prepared when tax season comes knocking. So, what are you waiting for? Log in, download, and tick off this essential task from your to-do list today.