A term bulk deal and block deal are frequently used terms for stock market investment. If you are actively involved in stock market investment you might have heard about these terms. A bulk deal or block deal are generally done by Mutual Funds, foreign institutional investors, HNI, Banks, Insurance firm and big investors. There are many people who follow bulk deal and block deal data of big investors like Rakesh Jhunjhunwala, Porinju Veliyath etc. to make their portfolio.

These terms may sound similar but they are different. Let’s try to identify a difference between Bulk Deal & Block Deal.

Bulk Deal

- A bulk deal means bulk transaction of share. A total quantity of the shares involved in the bulk deal is greater than 0.5% of the total number of share listed on the exchange.

- This type of deal is carried out during normal trading hours provided by broker. A bulk deal is visible to everyone.

- Bulk deals are market driven and can be carried out throughout the day.

- A broker has to give information about bulk deals to the exchange. If it is single trade deal information should be sent to exchange immediately. If it is multiple trade deal broker has to send information to exchange within one hour of the deal.

Block Deal

- A block deal is a trade where a minimum number of 5 Lakh shares or an investment amount of Rs.5 Cr is executed through single trade on a separate “Block Deal Window”.

- Block deal takes place when two parties agree to buy or sell shares at an agreed price.

- This deal takes place via a separate trading window. This type of deal is not visible via regular a market window.

- A 35 min time in the morning is allocated for Block deal – from 9:15 AM to 9:50 AM.

As per guideline of SEBI block deal share price should be between +1 or -1% of the current market price.

Why Bulk Deal and Block Deal are Important for Investors?

The Stock market is governed by FII, Big investors, Bank, Insurance firm and other institutions. These bodies invest in large quantity. They generally prefer transaction via bulk deal or block deal. The transaction done via this method move stock either up or down. These deals give an indication of buying and selling stocks to the investors. This indirectly means Investor dealing in the stock market can rely on data of bulk and block deals for trading cues.

An Investor should not totally rely on bulk and block deal. Sometimes operators are involved doing this type of trade in a specific counter. You should use data of bulk deal and block deal cautiously. If you are interested in bulk deal and block deal data for analysis, here is a simple method to find this data.

How to Find Bulk Deal & Block Deal Data?

I will share two different methods to find this data. A first method is finding data from BSE and NSE exchange website directly. A second method is to find data from popular moneycontrol website.

Bulk Deal and Block Deal Data from BSE Website

- Visit BSE website.

- In the Quick Links (footer) you will be able to find a link for bulk deal and block deal.

- Once you click on that link, a screen will display current transaction details.

- If you want to find historical data or stock specific data please visit following website –

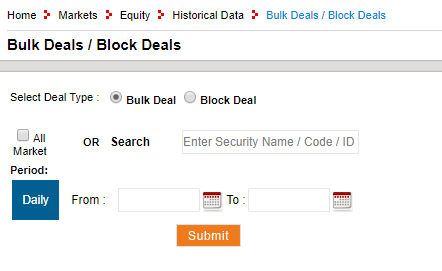

http://www.bseindia.com/markets/equity/EQReports/BulknBlockDeals.aspx

Select deal type, Enter security name and select date for which you want to find data. Click on submit and you will be able to see data.

Bulk Deal and Block Deal Data from Moneycontrol Website

- Visit the following link from Moneycontrol website.

http://www.moneycontrol.com/stocks/marketstats/blockdeals/bse/

- This website shows section wise data including major deals, MF deals, Larger deals and company specific deals.

- You have an option to select BSE or NSE exchange on this page.

- Enter the required information and press go button to find data.

Over to You –

Do you use bulk and block deal data for analysis?

Do share your experience in the comment section.

For latest update and information please subscribe to my blog.