My friend Sandeep is working in a multinational company. His monthly salary is 1 lakh, but still, he is unable to manage his household expenses. It often comes to his mind that even when he was earning 50 thousand at the beginning of his career, he was unable to meet expenses. Today, his salary is doubled, but he is still unable to meet expenses. This is a common story for almost every salaried person. They live paycheck to paycheck.

If you are a salaried person living paycheck to paycheck and unable to save money in spite of a good income, this post is for you. In this post, I will show how you can stop living paycheck to paycheck and save money for your future.

We’ll chat about real, down-to-earth strategies tailored for folks in India, where things like high inflation and job uncertainties make it even trickier. By the end, you’ll have a game plan to stop living paycheck to paycheck and start building a cushion that lets you breathe easier. Let’s get into it!

Understanding the Paycheck to Paycheck Trap in India

Living paycheck to paycheck isn’t just a phrase; it’s a harsh reality for millions here in India. Picture this: you’ve got a decent job, maybe in IT or sales, but after deducting taxes, PF contributions, and that EMI for your bike or home loan, there’s barely enough left. Add in the festivals – Diwali shopping sprees that leave you broke – or unexpected medical bills, and you’re right back to square one. Why does this happen so often? Well, for starters, our economy’s booming, but wages aren’t keeping up with the cost of living. In places like Delhi or Chennai, rent alone can gobble up 30-40% of your take-home pay. And let’s not forget the cultural pull – family obligations, weddings, you name it. These pressures pile on, making it feel impossible to escape.

But hey, recognizing the problem is the first step! If you’re nodding along, thinking, “That’s me!”, then you’re ready to flip the script. Stopping the paycheck to paycheck lifestyle means shifting your mindset from survival mode to growth mode. It’s about small changes that add up big time.

Why Indians Often Fall into This Cycle

Diving deeper, several factors contribute to living paycheck to paycheck in India. First off, job instability – with layoffs hitting tech hubs like Hyderabad, folks are hesitant to save, fearing the worst. Then there’s the temptation of easy credit; apps like Paytm or credit cards make spending a breeze, but interest rates? Ouch! They can trap you in debt faster than you can say “EMI”. Not to mention, informal sectors where many work without steady incomes. Farmers in rural areas or gig workers in urban spots often live hand-to-mouth. And education? Many young grads start with student loans, kicking off their careers already in the red.

Transitional phrases aside, it’s crucial to see how these elements interconnect. For instance, high living costs in metros push people to suburbs, but then commuting eats into budgets. Exclamation point: It’s a vicious cycle! Yet, with some savvy moves, you can break out.

Building a Solid Budget to Escape Paycheck to Paycheck Living

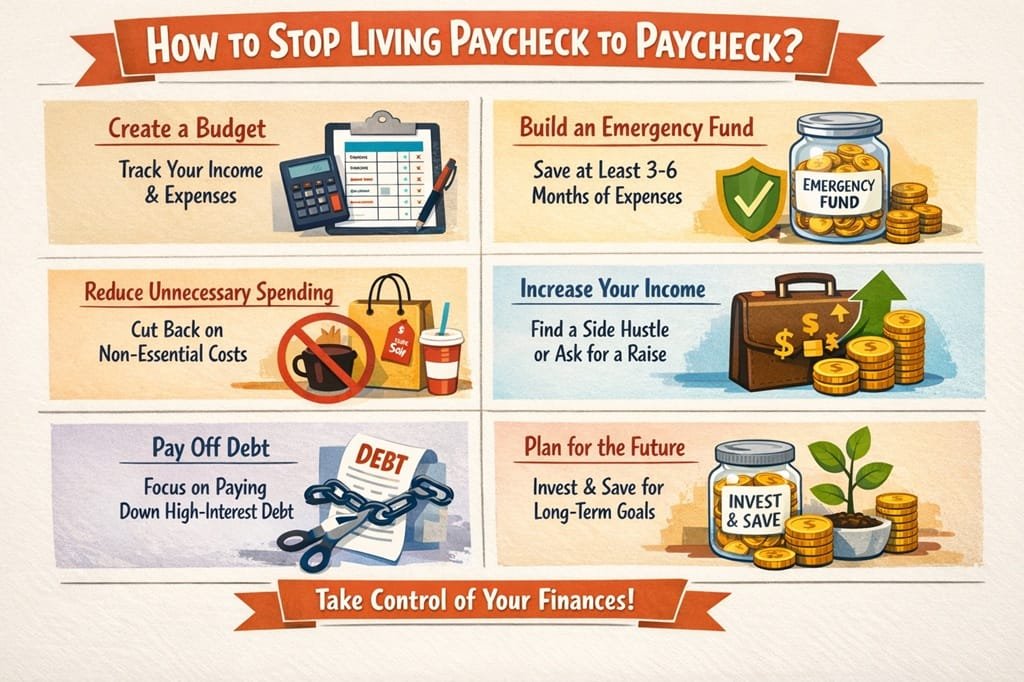

Alright, let’s talk basics. If you want to stop living paycheck to paycheck in India, a budget isn’t optional – it’s your lifeline. Think of it as a map guiding you out of the financial wilderness. Without one, money slips through your fingers like sand. But creating a budget? It’s simpler than you think, especially with free apps like Money Manager or even Google Sheets.

Start by tracking your income and expenses for a month. Jot down every rupee – that chai from the corner stall, the auto ride, everything. You’ll be shocked at where the leaks are. Once you’ve got the data, categorize it: needs (rent, food, transport) vs. wants (Netflix, eating out). Aim for the 50/30/20 rule – 50% on needs, 30% on wants, 20% on savings. Adjusted for India, maybe tweak it to 60/20/20 because essentials cost more here.

Practical Budgeting Tips for Indian Households

- Track Religiously: Use apps like Walnut or just a notebook. Set reminders on your phone – “Did I log that Swiggy order?”

- Cut Hidden Costs: Those daily coffees add up! Switch to home-brewed, saving hundreds monthly.

- Involve the Family: If you’re married or living with parents, get everyone on board. Discuss openly – no judgments.

- Handle Irregular Incomes: For freelancers in creative fields like writing or design, average your earnings over three months and budget conservatively.

Hanging in there, adjusting as you go, your budget becomes second nature. Before long, you’ll notice extra cash at month’s end, easing that paycheck to paycheck stress.

Smart Saving Strategies Tailored for India

Saving money when you’re living paycheck to paycheck in India feels like climbing Everest in flip-flops, right? But it’s doable with the right approach. The key? Start small and build momentum. Even ₹500 a month compounds over time, thanks to interest.

First, open a savings account with high interest – think 7% from small finance banks like Ujjivan or Equitas. Or go for fixed deposits, but keep some liquid for emergencies. Government schemes rock here: PPF for tax-free savings, or Sukanya Samriddhi if you’ve got a daughter. These aren’t just safe; they beat inflation.

Emergency Funds: Your Safety Net

Don’t skip this! Aim for 3-6 months’ expenses in an easy-access account. Living paycheck to paycheck means one flat tire or doctor’s visit can derail you. Build it gradually – automate transfers post-payday. In India, with monsoon floods or job shifts, this fund’s a lifesaver.

- Automate Savings: Set up SIPs in mutual funds via apps like Groww. Start with ₹1000; watch it grow.

- Cut Subscriptions: Audit your apps – do you need Prime, Hotstar, and Netflix? Pick one!

- Shop Smart: Use BigBasket for deals, or local markets for veggies – fresher and cheaper.

- Side Savings Hacks: Sell old stuff on OLX; that unused gadget could fetch ₹2000.

Moreover, reward yourself occasionally – a small treat keeps motivation high. Exclamation: You’ve got this!

Boosting Your Income: Side Hustles and Career Moves

If cutting costs isn’t enough to stop living paycheck to paycheck in India, crank up the income side. Easier said than done, but options abound. With the gig economy exploding, thanks to platforms like UrbanClap or Swiggy, extra cash is within reach.

Consider your skills: Good at English? Tutor online via Vedantu. Tech-savvy? Freelance on Upwork for global clients – dollars convert nicely to rupees! Or start a YouTube channel on cooking Indian recipes; monetize once views hit.

Upgrading Your Main Job

Don’t just hustle on the side; aim higher at work. Negotiate a raise – prep data on your contributions. Or switch jobs; in IT, hopping every 2-3 years boosts pay by 20-30%. Certifications like AWS or digital marketing via Coursera open doors.

- Gig Ideas for Indians:

- Delivery: Zomato or Amazon Flex – flexible hours.

- Content Creation: Blog on Medium about personal finance; earn from ads.

- Tutoring: For school kids, especially in smaller towns.

- Handicrafts: Sell on Etsy if you’re crafty.

Transitionally, combining gigs with skill-building ensures long-term escape from paycheck to paycheck woes.

Managing Debt Wisely in the Indian Context

Debt’s often the culprit keeping you in the paycheck to paycheck loop in India. Credit cards, personal loans – they seem helpful but snowball fast with 36% interest rates. Time to tackle them head-on.

List all debts: high-interest first, like cards, then loans. Use the snowball method – pay minimums on all, extra on smallest. Once cleared, roll that payment to the next. Apps like Cred help track and reward timely payments.

Avoiding Common Debt Pitfalls

Watch out for festive sales traps; buy only what you need. And EMIs? Only for big-ticket items like homes, not gadgets. If overwhelmed, consider debt consolidation via banks like SBI.

- Debt Reduction Steps:

- Negotiate rates with lenders.

- Use windfalls (bonuses) to pay down.

- Avoid new debt – cut up cards if tempted.

Dangling a bit, celebrating each payoff milestone keeps spirits up. Before you know it, debt-free life’s calling!

Investing Basics to Build Wealth

Once savings are in place, invest to outpace inflation – key to stopping living paycheck to paycheck in India. Stocks? Volatile, but mutual funds via SIPs smooth it out. Start with index funds tracking Nifty 50.

Gold’s traditional here; digital gold on Paytm’s safe. Or real estate, but that’s big bucks. For beginners, ELSS funds save taxes too.

Beginner-Friendly Investments

- Mutual Funds: Low risk, professional management.

- Stocks: Via Demat accounts on Zerodha; research via Moneycontrol.

- Crypto: Risky, but regulated now – small dips only.

- Insurance: Term plans for protection, not investment.

However, diversify – don’t put all eggs in one basket. Consult a SEBI-registered advisor if unsure.

Lifestyle Changes for Long-Term Stability

Escaping paycheck to paycheck in India isn’t just money moves; it’s lifestyle tweaks. Downsize if rent’s killing you – move to affordable areas like Pune suburbs. Cook at home; meal preps save time and cash.

Build habits: Read books like “Rich Dad Poor Dad” for mindset shifts. Join communities on Reddit’s r/personalfinanceindia for tips.

Health and Wellness Ties

Stress from finances affects health – ironic, since medical bills worsen it. Exercise free at parks; eat home-cooked to stay fit.

- Daily Habits:

- Walk instead of Uber for short trips.

- Grow veggies if space allows – fun and frugal!

- Network: Attend free meetups for job ops.

Exclamation: Small changes, big impacts!

Government Schemes and Resources

India’s got your back with schemes to help stop living paycheck to paycheck. Atal Pension Yojana for retirement, PMJJBY for insurance at ₹330/year.

For women, Beti Bachao Beti Padhao aids education. Unemployed? Skill India programs upskill for better jobs.

Accessing These

Visit government sites or apps like UMANG. Local banks guide on applications.

- Key Schemes:

- NPS: For pension building.

- PMEGP: Loans for startups.

- Mudra Loans: For small businesses.

Utilize them – they’re designed for folks like you!

FAQs

How long does it take to stop living paycheck to paycheck in India?

It varies, but with consistent effort, 6-12 months for basics like an emergency fund. Stick with it!

What’s the best app for budgeting in India?

Try Money View or Walnut – user-friendly and track Indian banks seamlessly.

Can I invest with low income?

Absolutely! Start with ₹500 SIPs in mutual funds. Every bit counts.

How to handle family financial pressures?

Communicate boundaries kindly. Suggest shared contributions for big events.

Is side hustling taxable?

Yes, declare income. Use ITR forms; apps like ClearTax help.

What if I lose my job?

Tap emergency fund, update LinkedIn, apply via Naukri. Government unemployment aid might apply.

Conclusion

Whew, we’ve covered a lot, haven’t we? From budgeting basics to investment insights, all geared toward helping you stop living paycheck to paycheck in India. Remember, it’s not about overnight miracles – it’s those steady, smart choices that build real freedom. You’ve got the tools now; time to put them into action. Imagine waking up without that salary countdown anxiety, maybe even planning a family vacation without stress. Exciting, right? Start today, one step at a time, and watch your financial world transform. You’ve earned it – go break that cycle!