Income Declaration Scheme – Ever since I started earning money I have started paying tax because I believe in saying “Taxes are paid nation are made”. However, I find a majority of people in India are dishonest when it comes to paying taxes. It is surprising to note that in India only 1% of people pay income tax. Black money and undisclosed income are quite common in India. In order to increase taxpayer base and in order to increase revenue Income Tax department has started Income Declaration scheme.

What is Income Declaration Scheme 2016?

Income Declaration Scheme 2016 is a one-time opportunity to all people, who have not declared correct income in the past to come forward and declare such undisclosed income. If you failed to furnish return or failed/forgot to mention income detail in your return you can declare the same by IDS scheme. Silent features of Income Declaration Scheme 2016 is given below.

- IDS is a scheme to declare undisclosed income in form of asset or otherwise pertaining to FY 2015-16 or earlier years.

- The fair market value of such asset as on 1st June, 2016 computed for declaration.

- Taxes, surcharge and penalty are applicable to the undisclosed income on the declaration.

- Total tax on undisclosed income will be 30% and a surcharge will be 25%. So, total payment of 45% to be done on such undisclosed income.

- This scheme is open for declaration from 1st June, 2016 to 30th Sept, 2016.

- Tax, Surcharge and penalty to be paid by 30th Nov,2016

- No scrutiny/inquiry shall be done under Income Tax/wealth tax with respect to such declaration.

- Name and detail of person shall be kept confidential and shall not be declared.

Also Read – Income Tax Calculator Download FY 2018-19

How to declare Income under Income Declaration Scheme 2016?

There are two modes of declaring income under Income Declaration scheme 2016 (1) Offline (2) Online

Offline mode of declaration –

Declaration of income using offline mode is very easy. Follow the steps given below for offline income declaration.

Step -1 Download and fill Form 1 for the declaration.

Step -2 Deposit duly filled Form 1 to the jurisdiction Principal Commissioner.

Online mode of declaration –

In order to declare income under online mode follow the steps given below.

Step -1 Visit Income Tax e-Filing portal. Under “Downloads” section click on “Forms (Other than ITR)”.

Step -2 Download Form 1 (IDS) utility.

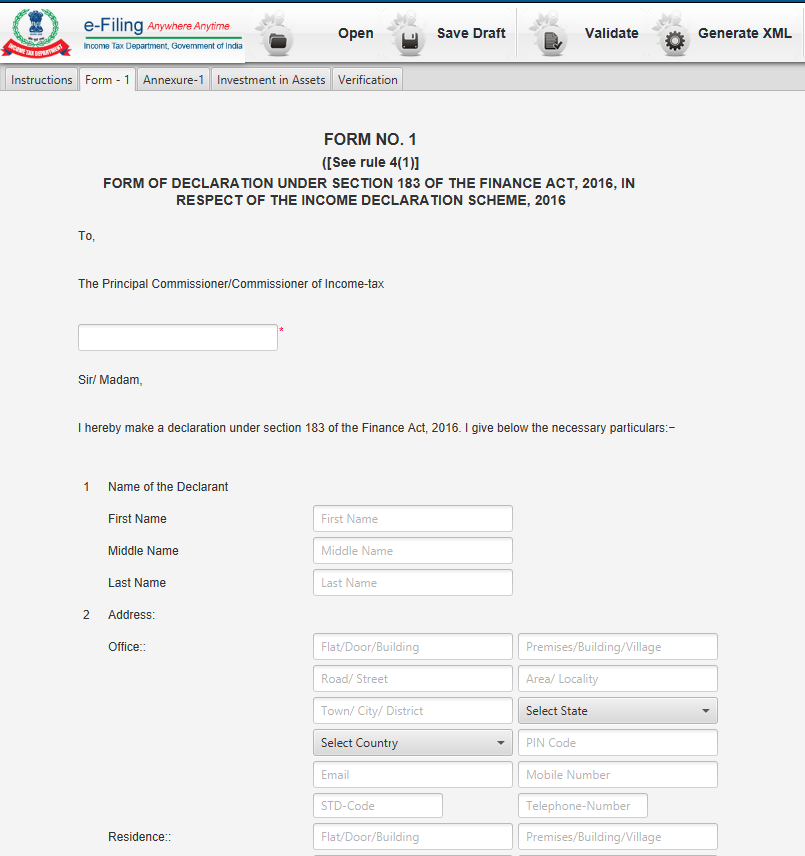

Step -3 Open ITD Filing Form 1 utility and click on Form 1 Tab.

Step -4 Complete the activity of filling Form 1. Once you are done press on Generate XML button.

Step -5 After Checking validation error. The utility will generate valid XML file.

Step -6 Next step is to upload this XML file and validate it using EVC or digital signature.

Also Read –25 Common Income Tax mistakes to avoid while filing ITR

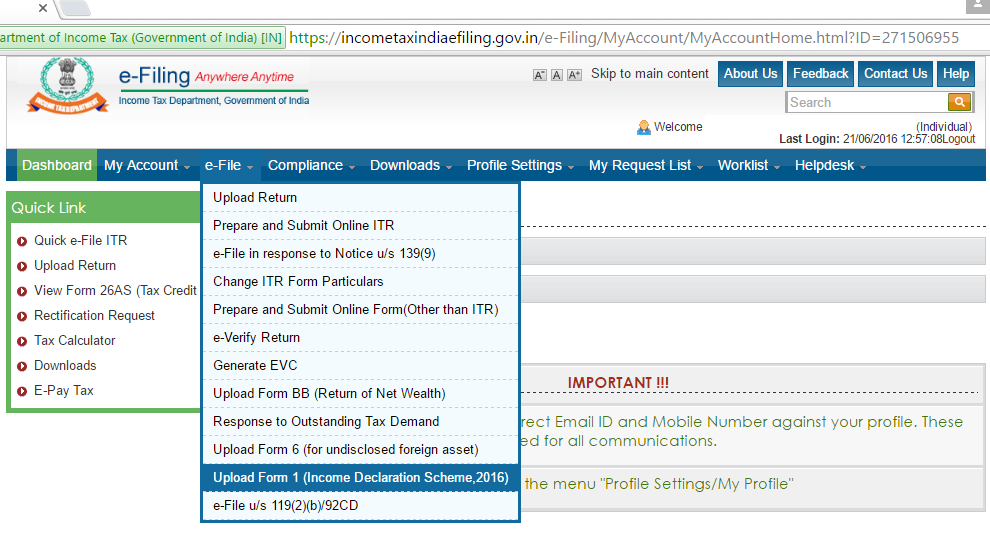

Step -7 Login to Income Tax e-filing website and go to e-File > Upload Form for Income Disclosure – Form 1 (Income Declaration Scheme 2016).

Step -8 Upload XML file and attach valuation report if any. Verify Form1 using a digital signature. EVC option is yet not available for Form1 Verification.

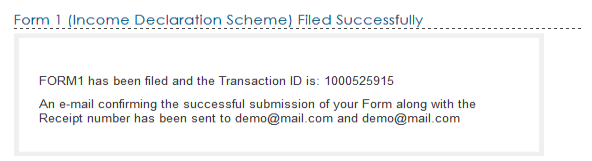

Step -9 Once Form1 is uploaded successfully following success message will appear.

Should you declare your undisclosed income under IDS 2016?

Paying tax honestly is your duty. If you have not paid your tax honestly it is recommended that you file Income Declaration Form 2016 and use this opportunity to become the law-abiding taxpayer. This scheme can save you from scrutiny or income tax enquiry for the declared income. It will also immune you from Benami Transaction Act, 1988 subject to certain conditions.

PM Narendra Modi has also urged tax payers to declare undisclosed income before 30th Sept, 2016 in Man ki Baat session.

Important points about IDS 2016 –

- IDS declaration can be filed by Individual, HUF, company, Firm or Any other associate.

- A person cannot make a declaration under the scheme if his undisclosed income has been acquired from money earned through corruption.

- It is not mandatory to file valuation report of undisclosed income.

- Validation of Form1 through EVC is not available yet, however it is said that this facility will be available soon.

- The person will not eligible for the scheme for those assessment years for which a notice is issued to him/her.

Over to you –

I hope you have clearly understood Income Declaration Scheme 2016. So, bring your undisclosed income under tax umbrella. Your undisclosed income is like Bomb-Defuse the tension and declare your undisclosed income under Income Declaration scheme 2016.