Buying a health insurance policy is a vital need today. Let me share with you one incident, Last Saturday I visited the hospital to meet my friend, he is suffering from a severe heart problem. The doctor advised him to undergo heart surgery. However, due to a lack of money and health insurance, he is unable to complete his treatment.

Many Indians are like my friend, as they avoid buying a health insurance policy. They don’t understand that health problems do not give advance notice before knocking the door. One should be ready for medical emergencies at any time. One should buy adequate health insurance covering all family members against major diseases. The health insurance policy offers risk coverage against expenses caused by any medical emergencies.

In the last few years, health insurance products has become a bit complex. Earlier health insurance policies were only covering hospitalization expenses, but now even OPD, pre and post-hospitalization expenses including maternity and dental treatment have come under the insurance net. Apart from this many other interesting features are added in health insurance policies.

People get confused while buying a health insurance policy, in order to help them here is a complete information guide about buying the best health insurance policy in India.

Buying a Health Insurance Policy in India

Point #1 – Deciding Sum Assured

The first point that comes while buying a health insurance policy is deciding the sum assured. You need to decide how much coverage is enough for you and your family. In order to decide the right sum assured you need to assess your lifestyle.

If you and your family are fit, following healthy habits including regular exercise, don’t smoke, had a clean medical history, you are in a good situation and require less risk coverage. If not your risk coverage requirement is high.

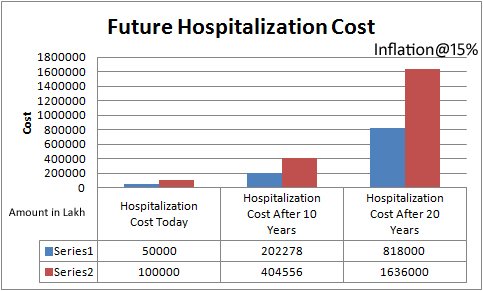

Another factor you need to consider before buying health insurance is inflation in the medical field. Medical expenses are growing at the rate of 15%. Hospitalization cost today is in the range of Rs. 50000 to Rs. 1 Lakh. Assume that you are 30 years old and inflation is in the range of 15% for the next 20 years, hospitalization bill will be in the range of 8 Lakh to 16 Lakh when you are 50 years old.

Looking at the current trend you should buy a health insurance policy with sum assured not less than 15 Lakh.

Point#2 – Individual Cover or Family Floating Plan

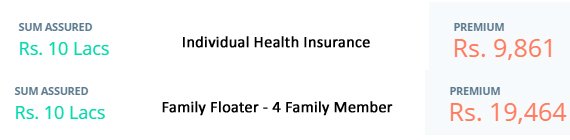

Secondly, you need to decide whether you want an Individual coverage plan or a Family floater plan.

Individual Coverage – Individual health insurance policy is a separate policy for the individual.

- This type of policy is suitable for old age person where more risk coverage is required.

- Individual coverage policy is more expensive

Family Floater – Family floater is a shared coverage policy that provides fixed coverage among all family members.

E.g If you take a family floater plan of 10 Lakh, all family members among the family have covered with maximum amount i.e 10 Lakh. Anyone can utilize this entire amount throughout the year. If a partial amount is utilized by one family member, coverage of the remaining amount is applicable to the remaining family member throughout the year.

- The family floater plan is suitable for young families with low-risk coverage.

- It is less expensive compared to individual health policy.

- The only disadvantage of this policy is if one family member has utilized more amount coverage will be limited to the remaining amount.

Family floater plan means saving of money.

Point#3 – Room Eligibility Capping (Limit and Exclusion)

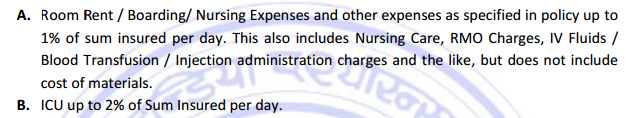

Some Health insurance policies come with a clause of hospital room rent limit. The clause says that the room rent limit is 1% of the total sum assured or a fixed amount says Rs 5000 whichever is lower. This seems to be a very small restriction, however, this will have a huge impact on the insurance claim.

You need to be careful while accepting the actual clause mentioned in the policy document. Let’s take a look at the following clause taken from the New Indian assurance health policy.

One should not purchase policy mentioning clauses like the above. This will be a limiting factor to your claim.

Medical expenses are growing every day and restrictions like the above will take your policy on the toss.

Point#4 – Maternity Coverage

Special health insurance policies for women are available nowadays. If you are expecting growth in your family you can plan to buy a health insurance policy with maternity coverage benefit. It is add-on coverage to standard health insurance.

Maternity coverage offers cover for medical expenses incurred at the time of pregnancy and delivery.

Point#5 – Hospital Network coverage & Cashless claim

You should review and obtain information about Hospital Network coverage offered by health insurance policy. An Insurer with a broad list of the hospitals in its network across India should be given a preference.

Apart from this you should also look at the cashless claim facility available with the insurer. The cashless facility provides an additional advantage as you do need not to arrange for cash for treatment.

Point#6 – Sublimit or Co-pay

When you buy a health insurance policy, you should be sure that the policy has no expense or disease-specific sub-limit. There are clauses like sub limit or co-pay in most of health insurance policies.

It is a critical feature while evaluating health policy, a policy with a sub limit will put you in an unpleasant situation at the time of claim settlement.

Point#7 – Pre-existing disease coverage

If you are suffering from any disease you need to mention that while buying a health insurance policy. The insurer will not provide you coverage against these diseases at the time of buying the policy. However, depending upon policy terms and conditions these diseases will be covered after 1 year or 2 years.

Point#8 – No claim bonus

The insurer provides you No claim bonus if there is a year where no claim is made against the policy. No claim bonus means an increase in coverage without additional premium. One should check the quantum of No claim bonus provided by the insurer. No claim bonus is in the range of 5% to 50%. A high no claim bonus policy is advisable as it safeguards you against growing inflation.

Point#10 – Annual Free Checkup

Free Annual Medical Checkup is a term used by the insurer, but believe me “There is no such thing as a free lunch”. Everything has a cost and it is bundled. If you are keen on getting an annual medical checkup done every year you should opt for it.

Another fact is an insurance policy is getting renewed every year and it is a long-term affair. Think that you will be able to go for an annual free checkup every year?

Point#11 – Restore Benefits

This is a newly introduced feature by various insurance companies. It says that if you or your family member exhausts your sum assured during the year. The health insurance policy will restore the full amount back for usage for any new disease without any charge. You should select this feature if it is really required by you.

Conclusion –

Buying a Health insurance policy is an important decision of your financial planning. Before buying health insurance, you should read all policy-related documents carefully. If you are unable to understand the terms/clauses ask as many questions as you can to the Insurance advisor to clarify all your doubts. It is better to clear confusion before buying an insurance policy.