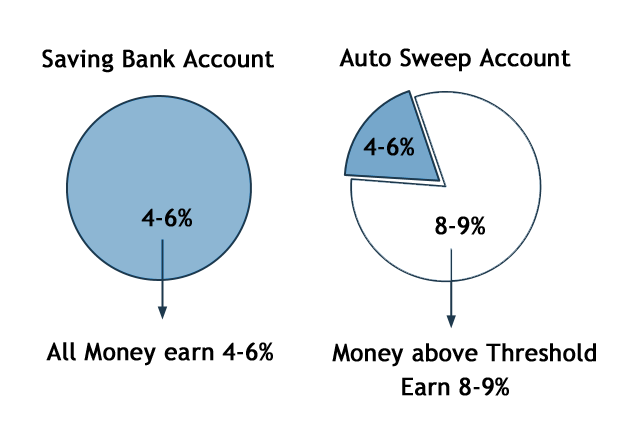

Saving bank account is the most preferred method to keep extra money but saving bank accounts only gives interest in a range of 4-6%. What to do to earn maximum interest. Well, today we will discuss 10 best savings bank accounts with an auto sweep facility that can earn more interest.

Saving bank accounts are a crucial aspect of personal finance, offering a safe and convenient way to store money while earning interest. In a country like India, where financial stability is highly valued, choosing the right saving bank account can make a significant difference in optimizing one’s savings.

Saving bank accounts are designed to encourage saving habits among individuals by providing them with a secure place to deposit their funds. These accounts offer a modest interest rate on the deposited amount, making them an ideal choice for short-term savings goals and emergency funds.

Importance of Earning Maximum Interest

Earning maximum interest on your savings can help your money grow over time, outpacing inflation and increasing your purchasing power. With the right saving bank account, you can harness the power of compounding and watch your wealth accumulate steadily.

Factors to Consider Before Choosing a Saving Bank Account

Interest Rate

The interest rate offered by the bank is one of the primary factors to consider when selecting a saving account. Higher interest rates mean more significant returns on your deposits, allowing you to maximize your savings potential.

Minimum Balance Requirement

Some banks impose a minimum balance requirement on saving accounts. It’s essential to choose an account with a minimum balance that aligns with your financial situation to avoid unnecessary charges or penalties.

Additional Benefits

Apart from interest rates and minimum balance requirements, consider other perks offered by the bank, such as cashback rewards, discounts on shopping, or complimentary services like insurance and bill payments.

Auto Sweep Facility

Auto sweep facility provides the combined benefit of saving bank accounts and fixed deposits. This facility interlinks your saving bank account with a fixed deposit account.

This facility makes sure that extra money crossing the threshold limit defined by you will automatically get transferred to a fixed deposit account and you will earn a better returns.

Example How Auto sweep facility can earn you more return?

Suppose your saving bank account has Rs. 1 lac for 1 year. In a normal saving bank account, it will earn interest 4% which is Rs.4000 for year.

If you have an auto sweep facility with a threshold limit of Rs. 10,000 than an additional Rs.90000 will form a fixed deposit and earn 8% interest.

At year-end you will earn Rs. 400 interest earned from Rs. 10,000 plus Rs.7200 interest earn from Rs.90000. So Total interest will be Rs.7600 which is far greater than the interest earned in the first case.

Accessibility and Convenience

Consider the bank’s accessibility and convenience, including online banking features, ATM networks, and customer service availability. Easy access to your funds and account management tools can enhance your saving experience.

10 Best Saving Bank Accounts to earn maximum interest

Today multiple banks provide auto sweep facility but they name it differently. HDFC bank calls it Sweep-in. ICICI bank calls it money multiplier and SBI calls it saving plus. Below is list of 10 Best Saving accounts which can earn maximum interest.

- SBI – Saving Plus Account – Multi Option Deposit

- ICICI – Money Multiplier Account

- HDFC – Sweep –in

- Axis Bank – Encash 24

- Union Bank – Union Flexi Saving Account

- Bank of India – BOI Savings Plus Scheme

- Bank of Maharashtra – Mixie Deposit Scheme

- United Bank of India – United Bonanza Savings Scheme

How to Open a Saving Bank Account

Opening a saving bank account is a straightforward process that can be done online or by visiting the nearest branch of the bank of your choice. You will need to provide certain documents, such as identity proof, address proof, and passport-sized photographs, as per the bank’s requirements.

Tips to Maximize Savings

- Set up automated transfers to your saving account to ensure regular deposits.

- Take advantage of promotional offers and bonuses offered by the bank.

- Monitor your account regularly and review your financial goals to adjust your savings strategy accordingly.

- Consider diversifying your savings portfolio by investing in other financial instruments like mutual funds or fixed deposits.

Conclusion

Choosing the right saving bank account is essential for maximizing your savings and achieving your financial goals. By considering factors such as interest rates, minimum balance requirements, and additional benefits, you can select an account that suits your needs and helps you grow your wealth over time.

FAQs

Are saving bank accounts safe? Yes, saving bank accounts are considered safe as they are regulated by the Reserve Bank of India (RBI) and offer deposit insurance up to a certain limit.

- Can I open multiple saving bank accounts? Yes, you can open multiple saving bank accounts with different banks to diversify your savings or take advantage of various offers.

- Is there a penalty for not maintaining the minimum balance? Yes, some banks may impose penalties or charges for not maintaining the minimum balance required in the saving account.

- Can I withdraw money from my saving account anytime? Yes, saving accounts offer liquidity, allowing you to withdraw money whenever needed through ATMs, branches, or online banking.

How often do saving account interest rates change? Saving account interest rates can vary depending on economic conditions and bank policies, but they typically don’t fluctuate as frequently as other interest rates.