Kaun Banega Crorepati? The KBC9 registration is open and the craze of becoming Crorepati is crossing the limit. Every tom, dick and harry is trying to register with KBC. It seems everyone wanted to be crorepati. Well, I am not going to share any method of quick registration with KBC, However, I will be sharing detail about a mutual fund that has made investor crorepati from lakhpati. Well, before moving ahead I would like to state that this post is not for advertising or recommending any specific mutual funds for investment. This post is to show real life example how one can become crorepati by mutual fund investment.

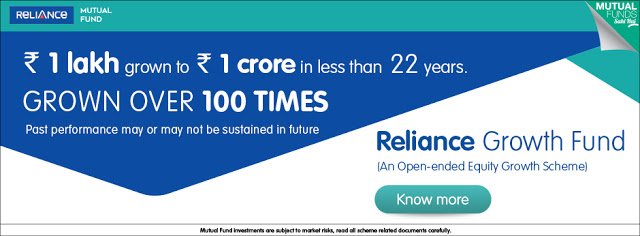

Recently I have seen one advertisement stating Rs 1 Lakh grown to Rs 1 Crore in less than 22 years. Grown over 100 Times. The advertisement was about Reliance Growth Fund (Open ended equity growth scheme). The advertisement sample is given below.

1 Lakh to 1 Crore by Mutual Fund Scheme

Reliance Growth Fund was launched in the year 1995. The NAV of this fund at that time was Rs.10. If you could have invested 1 lakh in this fund, number of units credited to your account would be 10,000 units. As of now (June,2017), NAV of this fund is Rs.1039. This means that it is grown by 100 times in last 22 years.

Thus, the present value of above investment works out to be 1.03 Cr. In short, it is proven that apart from KBC, investment in a mutual fund can also make you crorepati. So, if you are not getting a chance to participate in KBC, you must think of participating in mutual funds.

Also Read – SBI Mutual Fund Bandhan SWP – Should You Invest?

The entire amount 1.03 Cr indicated above would be tax free. In terms of CAGR, (Compounded Annual Growth Rate) return works out to be 23.5%.

Few key lessons learned from above example is given below.

Lesson 1 – There are alternatives to KBC

There are alternatives to KBC. You can also become crorepati by making an investment in mutual fund. Reliance Growth Fund is just an example. There may be many more mutual funds which are making investors crorepati. However, it is true that mutual fund cannot make you crorepati overnight like KBC.

Lesson 2 – Fund Selection Matters

Your return on investment is purely deepened on selection fund. It is important to select the right fund for investment. All funds cannot flourish and cross NAV of Rs.1000 like Reliance Growth fund. However, you can surely get a good return by making an investment in mutual funds.

Lesson 3 – Growth Option Matters

It is advisable to select growth option while making an investment in mutual fund. If we compare NAV of Reliance Growth Fund and dividend fund, there is a big difference. NAV of Reliance Growth Fund (Growth option) is Rs.1039 (June,2017) at the same time NAV of Reliance Growth Fund (Dividend option) is Rs.68 (June,2017).

It does not mean that returns were affected. The returns were given to investor via dividend route which investor might have spent.

Also Read – Best Stocks to buy in India for long term Investment

Points to Consider before making Investment in Mutual Funds

- You should be absolutely clear about time horizon expected return and investment objective before making an investment. You should build your mutual fund portfolio based on your financial goals.

- It is not necessary to invest in multiple mutual funds. Invest in few mutual funds based on your goal. It is not necessary to invest in each category mutual funds to build your portfolio.

- Always select SIP route for investment rather than doing lump sum investment. Invest in mutual funds for the long-term at least 3 years or above. If you are a risk adverse investor you can start building your portfolio by investing in debt or balance funds.

- Never invest in mutual funds based on tips. Carry out proper analysis and research before making an investment. If you are unable to identify mutual fund take advice from expert or CFP.

- Carry out assessment and balance your mutual fund portfolio at regular interval. Consider STP (Systematic Transfer Plan) for switching from one mutual fund to other.

- If your mutual fund portfolio is generating negative returns, do not panic. Don’t redeem or Stop SIPs. Avoid taking any decision based on short-term market movements. Continue your SIPs for the longer period.

- Prefer direct mutual funds scheme. Always invest in Growth based mutual funds over dividend based mutual funds. Stay away from New Fund offers (NFOs).

- Please Remember “Mutual Funds Investments are subject to market risks. Please read the offer document carefully before investing”.

Do share your queries and comments.

Subscribe to our blog and get latest updates in your inbox.