As an Indian we are bound to pay multiple taxes :). We pay many types of taxes to the government of India. In this article I will discuss gift tax and wealth tax.

Although we don’t have separate tax called as “Gift Tax”, but if you are going to receive money exceeding value 50,000 Rs/- as a gift get ready to pay additional income tax.

Tax on Gift

Under Income tax law if you receive any sum of money or property as a gift without consideration it is chargeable under taxable income. This income is define under head “Income from other sources”. Even winning lotteries, interest income etc. also fall under this category.

Exclusion from Tax on Gift

Not all gifts are chargeable under income tax following exemptions are available.

- Gift received on occasion of marriage of the individual.

- Money or property received by will or as an inheritance.

- Gift or money received from a relative.

Gift only received from relatives like parents, spouse, siblings, daughter and son, spouse of daughter and son, spouse’s parents, Spouse’s siblings and their respective spouse. Even gift received from NRI relative with mention relationship is exempted.

So, you can enjoy tax-free gift or money from relatives. You can use this money or gift for any purpose ranging from purchasing of share or buying property or investments.

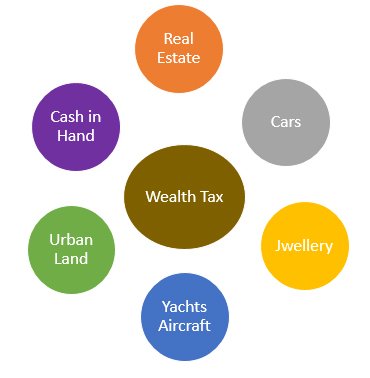

Wealth Tax

As per tax law every individual, HUF and Company with net wealth (asset less liabilities) exceeding 30 lac is liable to pay wealth tax. Valuation of these assets will calculated as on March, 31 & tax applicable is 1% of the amount exceeding 30 lac limit. No surcharge of cess is levied on wealth tax.

Wealth tax is applicable on Non-productive assets. Non- productive assets are assets which generate no income or passive income. Example of these assets are real estate, car, air craft, yachts, jwellery, urban land etc. Under wealth tax deemed assets those which are owned by spouse are also included.

Exclusion from Wealth Tax

Wealth tax is not applicable on Productive assets. Productive assets are assets which generate active income. Example of these assets are shares, mutual funds, fixed deposits, bonds etc. These assets are exempted from wealth tax.

Exclusion for Real Estate or Residential property

- Property occupied by assessee for his business or profession.

- Any residential property which is let out by assessee for minimum period of 300 days in the year.

- Any commercial property or establishments

- Property held as stock in trade – unsold flats of construction companies.

- Residential property allocated by company to employee whose gross salary is less than 5 lac.

Exclusion for Motorcar, Yachts & Aircraft

- Motor car used for business or held for hiring business.

- Motor car held as stock in trade

- Yachts & Aircraft used for commercial purpose

Exclusion for Jwellery

- All gold, silver and precious stone jwellery including artwork is included in wealth tax excluding jwellery which is held as stock in trade.

Exclusion of Urban land

- Urban land on which construction is not allowed.

- Land on which building is constructed with approval from authority.

- Unused Industrial land.

- Urban land held as stock in trade.

For wealth tax you need to file separate return form BA.

Hope all your doubts related to gift tax and wealth tax is clear. Please get back to us for getting more information about gift tax or wealth tax.