We all know health is wealth, but now a day with changing lifestyle our venerability to lifestyle disease is increasing at alarming speed. With increase in medical expenses it is advisable to have health insurance plan for you and your family as not having one can impact your finances very severely.

As all of you know there is multiple health insurance plans available in the market in past we have compared 42 health insurance policy some of policies are good and some of them are useless. It sometime becomes very difficult to recognize which is the best health insurance plan.

We understood your pain and we are herewith 5 health insurance plans which we feel are among the best available in the market.

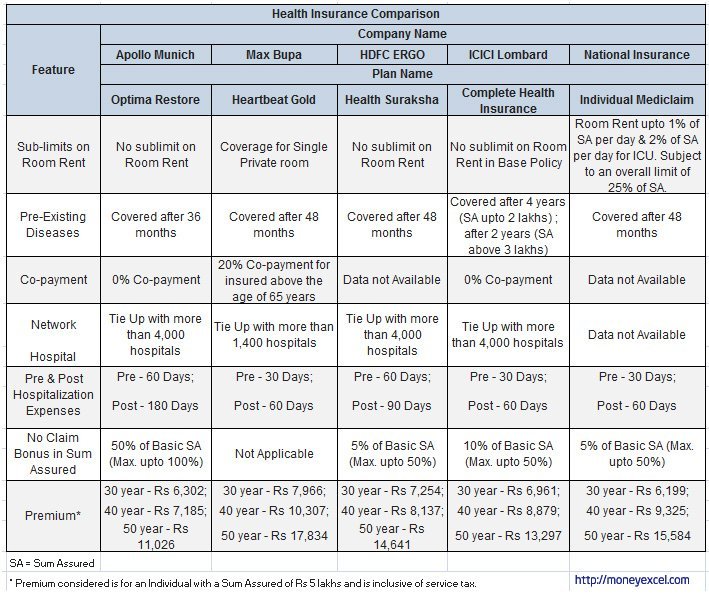

5 Best Health Insurance Plans:-

Four policies out of five shown here are from private insurance company and one is from non private PSU insurance company.

Top of the list we have health insurance policy from Apollo Munich – Optima Restore which provide unique benefit of claim restore and multiplier. Next we have HDFC Health Suraksha followed by Max Bupa Heart beat Gold & ICICI complete health insurance. At last we have Mediclaim policy from National Insurance.

To compare these plans we have considered certain basic features explanation of same is given below.

Feature Explanation:-

Sub-limits on Room Rent:-

From above table you can say that majority of private player do not set sublimit on room rent however national insurance is still placing limit on room rent.

As per us you should choose policy without any sub limit on room rent.

Pre-Existing Diseases:-

If you are worried about your pre-existing diseases don’t bother majority of health insurance company covers that but after waiting period of 3 to 4 years.

Select policy with lower waiting period.

Co-payment:-

Certain companies keep precondition that in case of pre-existing diseases or if age is above 65 years only partial claim is allowed e.g Max Bupa has 20% co-payment clause for an insured above the age of 65 years. Up to 65 years of age 100% claim is allowed but after 65 years age Max Bupa will be liable for only 80% of all your claim amounts while you have to bear the other 20% of the cost.

Network Hospital:-

Majority of insurance companies keep tie up with number of hospital which is called as network hospital. Nowadays most of the insurance companies have a tie up with around 3,000 – 4,000 hospitals but you should not get carried away with this number. You should look at list of hospital carefully and evaluate how many such hospitals are available in your city.

Pre & Post Hospitalization Expenses:-

This is another important feature one should look before purchasing health policy. Most of insurance company covers 30 days pre and 60 days post hospitalization expenses, but some company does cover 60 days pre and 90/180 days post hospitalization expense like Apollo Munich Optima restore and HDFC health Suraksha.

No Claim Bonus in Sum Assured:-

This means if you don’t claim any money than you will get bonus in sum assure. Many company provide 5-10% bonus but in case of Apollo optima restore you can get 50% no claim bonus.

Premium:-

In the above table we have mentioned premium for 3 different individuals having 30 year, 40 year and 50 years of age.

At last we would like to say that you must purchase health insurance policy if you have not purchased yet. Remember along with good health now it is mandatory to have good health insurance plan.

You must consider above mention health insurance policy while purchasing health insurance.

![Expert Tips to Improve Your Personal Loan Eligibility [2024] expert tips personal loan](https://moneyexcel.com/wp-content/uploads/2024/04/expert-tips-personal-loan-100x70.jpg)