Most of the investors search for multibagger stocks for investment. The term Multibagger was coined by Peter Lynch in his book One Up on Wall Street. Multibagger has become buzzword then after. Every stock market investor is looking for multibagger. It seems everyone wants to become a millionaire by investing in a potential multibagger stock.

Well, it is not easy to identify potential multibagger stocks for investment. However, if you apply the right technique and rules you can surely identify multibagger stock. We analyzed several multibagger stocks and investment technique adopted by stock market experts to know “How to find Multibagger Stocks”

Also Read – Multibagger & Consistent Performer Stocks for Investment 2019

What is Multibagger Stock?

A stock that gives several times returns on the cost is called multibagger stock. A stock that doubles its price is called two-bagger stock. If stock grows 10 times it is known as 10 bagger stock. If it grows by 100 times it is 100 bagger stock. Multi-Bagger stocks are undervalued stock with strong fundamentals, future business potential, and strong corporate governance.

Example of Multibagger Stocks in India – There are several stocks in India which have given multifold returns to the investors. Few examples of multibagger stocks are Titan, Bajaj Finance, Eicher Motors, TCS, Infosys are examples of multibagger stocks. These stocks have generated multifold returns for the investor over the long span.

How to find Multibagger Stocks? – Secrets of finding Multibagger

You should consider following parameters while identifying a multibagger stock for the investment.

Earning Potential

The first thing you need to check is earning potential. The company should be generating revenue consistently and increasing their earning. The business model of the company should be lucrative and sustainable. The product in which company is dealing must be in demand.

E.g Reliance JIO where the company is generating revenue consistently and increasing earning. Apart from that product of Reliance JIO is likely to remain in demand. Another example is Bajaj Finance. Bajaj Finance has done a fast turnover of capital, which has resulted in a lower cost of funds and the ability to serve more customers with the same resources.

Low or NO Leverage

You should select a company with a lower or minimum debt level. Ideally, the company should be cash rich with debt-free status. The debt-free status help company to do business expansion and acquisition of new businesses. Cash on hand gives freedom to fight against any adverse business situation.

Don’t select a company with capital intensive business such as business from the metal sector, infrastructure etc. These types of business are cyclic in nature and less likely to become multibagger.

In order to find debt level, you should look at the debt-equity ratio. Debt equity ratio of stock should be low. Some examples of low debt or debt-free companies are Britannia Industries, Bajaj Corp, and Lupin.

Expansion or New Product Development

Next important parameter while making selection is expansion or new product development. The company should be constantly expanding business or developing new products. One such example is Patanjali. Patanjali is constantly expanding the business and adding new products for increasing customer base.

Visionary Management

The management of the company should be visionary and competent. They should be able to take right decision with changing environment. Like adoption of new products, technology or changing business line. The management should be transparent and should be following corporate governance standards.

Performance History

The performance history of a stock is another important parameter. The company should be a consistent performer in terms of net profit margin and revenue. You can easily find out the performance history of the company from quarterly and yearly results.

EPS Growth Vs Valuation

The last to perform while finding multibagger stock is EPS Growth Vs valuation. The EPS of stock means company’s profit divided by a number of shares. The EPS of the share should be at a reasonable level and valuation of stock should not be very high. If a stock has already given a multifold return and valuation of the stock is very high it is not multibagger stock. That is the reason future multibagger stocks are from small cap and mid cap sector.

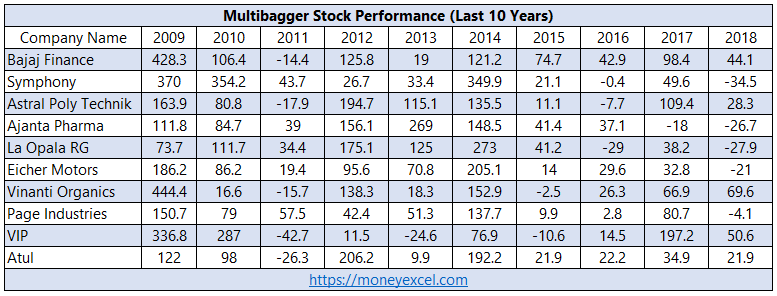

Top 10 Multibagger Stocks of last 10 years

Here is list of Top 10 Multibagger stocks of last 10 years. The returns given here for the calendar year.

Over to you –

What is your take on the method given above for the identification of multibagger stocks?

Do you have any other factors to add in above list?

Do share it in the comment section given below.

![Expert Tips to Improve Your Personal Loan Eligibility [2024] expert tips personal loan](https://moneyexcel.com/wp-content/uploads/2024/04/expert-tips-personal-loan-100x70.jpg)