The Ministry of Labour and Employment, Government of India has recently changed norms on EPF withdrawal. As per new rule full EPF withdrawal is not allowed up to retirement age. This change adversely impact individuals who frequently change job and withdraw the EPF amount. Let’s take a look at early EPF withdrawal rules and its impact on employees.

Note – As per latest update EPF withdrawal rules are rolled backed on 19th April,2016.

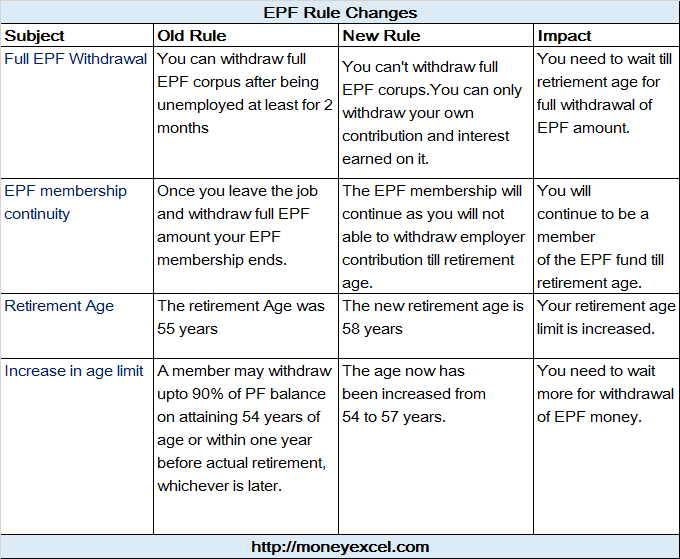

EPF Withdrawal New Rules

Full EPF withdrawal not allowed till retirement

Old Rule –

As per earlier rule, if a person leaves the job and remains unemployed for 60 days or above, he or she could able to withdraw entire EPF amount. However, now it is not possible.

New Rule –

As per new EPF rule notified on 10th Feb,2016 by the government, full EPF withdrawal is not allowed till retirement age. If a person is unemployed for 60 days and wishes to withdraw EPF amount, he or she is allowed to withdraw his or her own contribution and interest earned on it. The contribution of employer and interest earned on that can be withdrawn only at retirement age 58 years. So, if you want to utilize full EPF corpus for starting your own business before retirement you cannot.

Under new rule of EPF withdrawal exception is kept for female employees resigning from the services for the purpose of getting married or on account of child birth or pregnancy.

Also Read – How to change Mobile number in EPF UAN Account?

EPF membership Continuity

Old Rule –

As per earlier rule one could withdraw full EPF amount after resigning from the job, hence his/her EPF account deemed to be closed on withdrawal of EPF amount.

New Rule –

As full EPF withdrawal is not allowed now, an individual member can continue with same UAN Number after withdrawal of his or her own contribution. EPF membership will continue until retirement age of the member.

Retirement Age

Old Rule –

A retirement age was 55 years as per old EPF rules.

New Rule –

A retirement age as per new EPF rule is 58 years.

Increase in age limit for 90% EPF withdrawal

Old Rule –

You can withdraw 90% of EPF balance on attaining 54 years. One year before your retirement age.

Also Read – How to Verify Aadhaar & PAN at EPF UAN Website?

New Rule –

As per new rule, you cannot withdraw 90% of EPF balance on attaining 54 years. New retirement age is 58 years means you can withdraw 90% of EPF balance only on attaining 57 years of age.

Positive of New EPF withdrawal rules

- New EPF withdrawal rule will now allow withdrawing full EPF amount till retirement age. This will help members to build funds for their retirement, especially to people who never bother about retirement planning.

- A long term availability of funds to the PF authorities might result in better returns for the few members, who does not know how to invest their money.

Negative of New EPF withdrawal rules

- You will not able to use full EPF amount for doing business. Although, you may able to earn more money in business compare to EPF interest.

- Your EPF money will earn fixed interest only. This will impact your retirement corpus amount significantly. A smart investor may like to invest this money in a Mutual fund for earning better returns.

- You will not able to use this money during a hard time after leaving your job.

New Challenges

- As per current rule any EPF account not operated for 3 years become dormant EPF account. After applicability of this rule there will be many such accounts.

- No clarification is given that how EPF department will distinguish between actual inoperative EPF accounts and account with only employer contribution and inoperative.

- The employer contribution towards EPF is very low and may not serve significantly towards retirement savings.

Over to You –

What is your take on this new rule of EPF withdrawal?

Do you think the stringent rule of EPF withdrawal will help you in building your retirement corpus?

Do share your thoughts ideas in the comment section.

![Expert Tips to Improve Your Personal Loan Eligibility [2024] expert tips personal loan](https://moneyexcel.com/wp-content/uploads/2024/04/expert-tips-personal-loan-100x70.jpg)