Latest Recurring Deposit Rates– Recurring deposit is one of the simplest financial products available in the market. Recurring deposit means a repetitive deposit of money at a regular interval for earning fixed rate of return.

For example, you can open recurring deposit for Rs 500 for 9% interest rate for the tenure of 3 years with the bank. The bank will deduct Rs 500 for 3 years from your account. This amount will be accumulated in Recurring Deposit and earn 9% interest. This is same way depositing Rs 500 to the piggy bank at a specific date in a month except you will earn interest in Recurring Deposit.

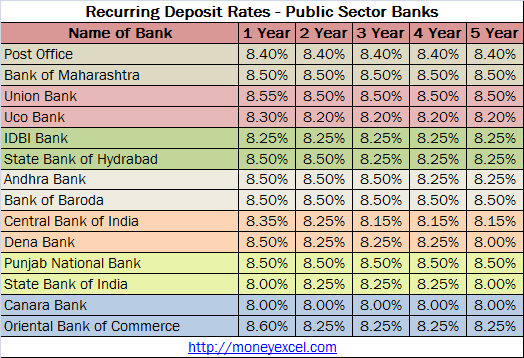

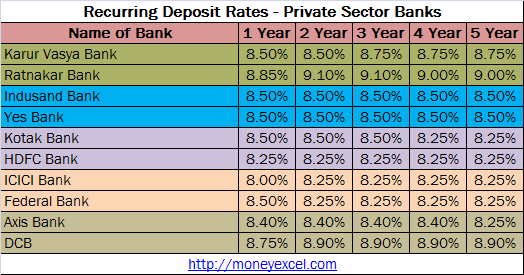

Every bank today offers recurring deposit facility. The key of maximizing return for recurring deposit is a selection of best recurring deposit scheme. So which bank is paying highest interest on recurring deposit? Let’s take a closer look at latest recurring deposit rates offered by banks in India 2015.

Latest Recurring Deposit rates

Recurring deposit rates shown above is for Non senior citizen. If you are senior citizen you will get extra interest on this deposit.

Best Recurring Deposit Schemes

SBI Recurring Deposit – e-RD

First best recurring deposit as per me is SBI Recurring Deposit called e-RD. Key features of this recurring deposit are given below. Recurring deposit rate for this e-RD remains same as shown in the chart above.

- e-RD by can be opened any time over the internet using Internet banking

- Minimum period of deposit is 1 year maximum is 1o years.

- Premature withdrawal is allowed

- You have a option to close this RD online.

For more information kindly visit SBI e-RD FAQ.

ICICI iWish Flexible Recurring Deposit

ICICI iWish flexible recurring deposit is another best recurring deposit which gives you flexibility of investment. Key features of this recurring deposit rate is given below.Recurring deposit rate for this RD remains same as that of other RD’s.

- Flexibility to save large or small amount as per availability

- No penalty for not depositing money for any month

- Your friends or relatives can contribute to this recurring deposit.

- You can track your progress against the goal of investment.

- Open two iWish Flexible RDs and get Rs.250 off at Jabong (offer valid till 10,July 2015)

For more information kindly visit iWish ICICI website.

I have selected best-recurring deposit as per my research, however, you may use your discretion before investing in any recurring deposit scheme.

In order to help you, I am here with few tips on Recurring Deposit.

Tips on Recurring Deposit

Tip -1

Recurring deposit is best for short term goals over a horizon of 1 year to 3 years. An example of Short-term goals is given below.

- Upcoming marriage expense (1 year to 3 years)

- Purchasing car in near future

- Upcoming Higher Education expense

- Planning for Vacation Tour with Family

You can Invest your surplus money in recurring deposit. Make sure you are investing in recurring deposit with a specific financial goal in mind.

Tip -2

TDS is not applicable on recurring deposit means banks will not deduct any tax, however interest income from recurring deposit is fully taxable.

Tip -3

One can break Recurring deposit anytime before maturity. A Certain amount of penalty interest will be deducted. This penalty varies from bank to bank.

Tip-4

The penalty is applicable in the case of you are failed to deposit money on time for recurring deposit, however, certain banks do not levy any penalty for late deposit.

Tip-5

If you have a problem in sustaining instalments for recurring deposit you can opt for flexi recurring deposit. Flexi recurring deposit allows you to have variable deposit amount under RD.

Tip -6

Don’t forget to give nomination for your Recurring deposit. This is to ensure that the nominee will get the amount in case of your unfortunate death.

Tip -7

You can avail loan facility against recurring deposit, however, it is advisable to take the loan only in the emergency.

Please do share your Feedback and comment on this article!